This article was co-authored by Jonathan Galea, CEO at BCAS, and Tom Berkman, Techincal Analyst at BCAS.

Stablecoins, the unsung heroes of the crypto world, offer a unique solution to the volatility of crypto-asset markets and have fundamentally changed how users transact on blockchains. By emancipating traditional money, stablecoins allow traders to sidestep volatility without having to liquidate their portfolios into fiat currencies – a more complicated process overall. Given their unique attributes, it is unsurprising that stablecoins have grown into a $100 billion dollar market and are used in nearly 70% of all on-chain settlements. [1] [2]

However, one of the challenges facing many stablecoins, is that unlike holding fiat currencies in a bank account, stablecoins held in one’s address or account generally do not tend to accrue interest. This is problematic from a risk-return perspective since holding stablecoins is arguably riskier than holding cash in a government-backed commercial bank, and no interest is earned to offset this additional risk. This point isn’t insignificant either; over the years we have seen multiple instances where stablecoins have exhibited notable volatility, and examples where stablecoins have completely de-pegged from their intended value. Moreover, most stablecoins are designed in a way to track the price of a national currency to date, meaning that holders aren’t even compensated for accepting this additional risk through an inflation hedge.[3] There is the option for stablecoin holders to potentially earn additional yield on their investments by engaging in certain decentralised finance (DeFi) strategies, however this comes at the cost of either taking on more leverage or accepting additional smart contract risk.

From an investor’s perspective, the disparity between holding cash and stablecoins becomes more pronounced during high interest rate environments like those seen in recent years.[4] In positive interest rate environments, why would an investor accept more risk by holding a stablecoin and earn less than holding cash in a bank?

Fortunately, the innovative realm of crypto-assets tends to address such inefficiencies through market-driven solutions. A prime example of such an innovation is the emergence of interest-bearing (IB), or yield-bearing, stablecoins. These stablecoins are designed to accumulate interest, aligning them more closely with the benefits of holding traditional currencies in bank accounts. To effectively address the risk-return imbalances inherent in conventional non-interest-bearing stablecoins, IB stablecoins must accomplish two key objectives. Firstly, they should generate a dependable yield, akin to that obtained on traditional currencies, with the holy grail being a foreseeable & fixed rate. Secondly, this yield must not introduce substantial additional risks to the holders of the stablecoin.

While IB stablecoins potentially serve as an improvement to holding non-interest bearing stablecoins, the holding and issuance of these assets may potentially introduce nuanced legal complications. This is especially relevant considering the soon-to-be applicable Markets in Crypto-Asset (MiCA) affecting crypto-asset service providers and issuers in the European Union (EU). MiCA has a substantial focus on the regulation of E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs) – two categorisations potentially affecting the issuance and offering of IB stablecoins.

For these reasons, we believe that now is an appropriate time to conduct a deeper examination on this emerging asset class. The analysis presented in this article is structured as follows: we begin with a brief definition and describe two characteristics inherent to all stablecoins. We then describe the mechanical architecture of two popular IB stablecoin designs – rebasing stablecoins and price appreciating stablecoins. In doing so we focus on two prominent examples in each categorisation. The second half of this article examines the legal implications of IB stablecoins by presenting an in-depth legal examination on the presented examples from a MiCA perspective.

What are stablecoins?

While many readers may be familiar with the term itself, the diverse range of stablecoins available extends the categorisation of what stablecoins are beyond what some may consider as the traditional types, with some novel stablecoin architectures quite frankly bordering onto the exotic. The aim of this article, however, is not to delve into a discussion on stablecoin classifications (for readers seeking further exploration, please refer to BCAS’s report on “Stablecoin Foundations”). Instead, our focus is on a specific category of stablecoins – those that accrue yield or interest. Crucial for the context of this discussion is understanding that stablecoins, for the purposes of this article, are defined as crypto-assets that generally satisfy the following two criteria:

- The crypto-asset intends to track the value of some external reference. In many cases this may be a national currency such as the US Dollar , however some stablecoins track the price commodities such as gold or even other crypto-assets.

- The crypto-asset is designed in such a way that it maintains its value relative to this external reference – a feature that is sometimes referred to as the stablecoin’s “peg”. Depending on the stablecoin design, different mechanisms can be utilised to ensure the stability of this peg. This may include various minting and redemption mechanisms, economic incentives, or algorithmic supply adjustments.

In the following section, we explore four examples of stablecoins that not only satisfy these criteria but also generate interest or yield in some capacity. We start with an examination of two rebasing stablecoins, followed by a discussion on two stablecoins designed to appreciate in price.

Rebasing Stablecoins

Mountain Protocol – USDM

Mountain Protocol’s IB stablecoin – USDM – is a rebasing ERC20 token pegged to the US Dollar. USDM is fully redeemable at a 1:1 value to the US Dollar, in exchange for the equivalent value in USDC. USDM is fully backed by Mountain Protocol’s reserves, which mainly include highly liquid assets such as short-term US Treasuries (T-bills) although other liquid assets such as Money Market Funds, Reverse Repurchase Agreements (repos) and Treasury ETFs are used.[5] Additionally, Mountain Protocol maintains established lines of credit denominated in OTC USDC to support the redemption of USDM by its users. Through this arrangement, users can exchange their USDM for USDC, with Mountain Protocol offering advances on these redemption requests using the credit lines. These advances are subsequently repaid by the Protocol using its reserve assets once the market is open. It is crucial to note that the reserves do not contain native USDC as an asset, ensuring that USDM is not affected by price fluctuations of USDC. Instead, USDC credit lines are solely used to facilitate users on-chain redemptions of USDM.

Importantly, Mountain Protocol relies on an over-collateralisation model, meaning that the assets held in its reserves are at least greater than the value of circulating USDM (the protocol’s debt). The over-collateralisation of this debt is important for two reasons.[6] Firstly, it helps stabilise USDM’s peg, especially in “bank-run” scenarios when liquid assets are needed to facilitate redemption requests. Secondly, it provides a collateral buffer during times of interest rate hikes, this means that the excess collateral in its reserves can be used to absorb any variations between the interest earned on its assets and the interest paid on its debt (yield to USDM holders).

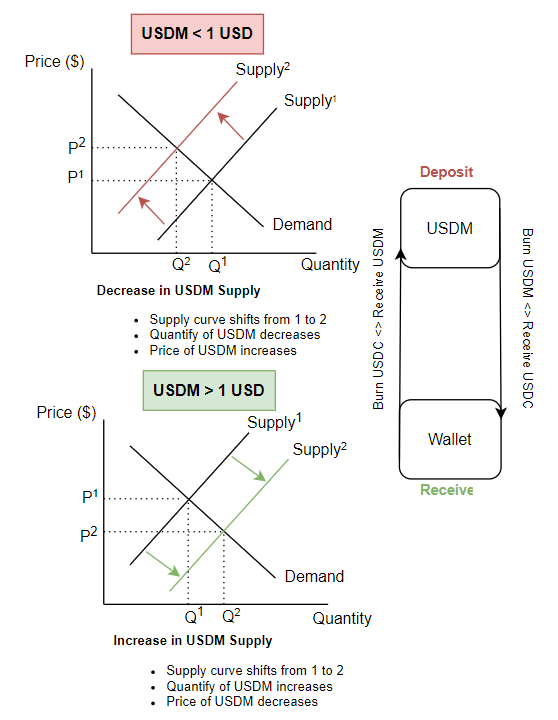

In this model, arbitrageurs play a key role in stabilising USDM's price around its $1 peg by minting USDM or redeeming it for USDM.[7] Figure 1 below illustrates how these actions impact USDM's supply and price in response to deviations from the peg. The two entities in this diagram include the USDM token contract (represented by USDM), and users minting or redeeming USDM in response to any price deviations around its peg (represented by Wallets).

The top half of Figure 1 depicts the scenario where USDM is trading below $1. In such a situation, users can potentially profit by selling USDM in exchange for USDC, reducing USDM's supply and raising its price. This is depicted by the supply curve shifting left from Supply1 to Supply2, decreasing available USDM from Q1 to Q2 and increasing the price from P1 to P2. Conversely, the bottom half of the Figure 1 represents a situation where USDM's price exceeds $1. Users are motivated to mint new USDM by depositing $1 worth of USDC and selling USDM at the higher price on the market. This increases the supply of USDM as shown by the supply curve moving right from Supply1 to Supply2, increasing the quantity of USDM from Q1 to Q2 and lowers its price from P1 to P2, thus steering USDM's market price back towards its peg.

As long as the price of USDM deviates from $1 arbitragers continue adjusting its supply until the market price of USDM is brought back in line with its peg.

Figure 1 - USDM Peg Mechanism

The technical implementation of USDM adds rebasing functionality to its ERC20 contract. In this design, instead of the token contract storing the USDM balance of each holder, it stores the shares of the total supply that each holder has.[8] This share structure is dynamic and changes whenever USDM is minted or redeemed (burned), ensuring that each holder's share accurately reflects their portion of the total USDM supply. It is through this mapping of shares to accounts that the rebasing process is facilitated, allowing interest to accrue, and be distributed to token holders. The underlying yield comes from the interest earned on Mountain Protocols reserve assets (such as interest on T-bills).

A crucial component to the rebasing design of USDM is a variable known as the rewardMultiplier, which captures the accrued yield or interest on the USDM tokens. The variable is updated through the addRewardMultiplier function which is called daily to adjust the value of the rewardMultiplier based on a pre-determined yield rate. This is a permissioned function only accessible to a wallet controlled by Mountain Protocol.[9] As this multiplier increases, so does the value of each share, thereby increasing the holder's USDM balance in line with the accrued yield. The reward multiplier thus serves not only as a reflection of the token's performance but also as a means to determine how much interest earned on the protocols reserves is distributed to token holders.

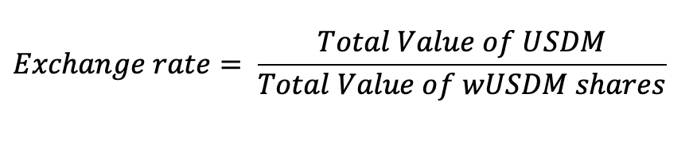

Rebasing tokens, though effective for distributing yield, present technical complexities in their integration with other protocols, primarily due to their design that maps shares instead of maintaining constant account balances. Mountain Protocol addresses this challenge by introducing wUSDM, a non-rebasing wrapped version of USDM.[10][11] The key advantage of wUSDM lies in its compatibility with existing DeFi protocols, as it operates as a token contract that tracks stable account balances, thereby eliminating the integration difficulties typically associated with rebasing tokens.

Like USDM, wUSDM accrues yield, however, it does so by appreciating in price instead of increasing account balances. This is enabled by leveraging the OpenZeppelin implementation of the ERC4626 Tokenized Vault Standard Contract, a framework commonly used to manage rebasing tokens.[12] This contract aims to reflect the yield accrued to rebasing tokens, into a non-rebasing representation where yield is reflected through price appreciation of a related ERC20 token. It achieves this through a share-based mechanism that mirrors the value of the deposited assets within the contract.[13] Upon depositing USDM, the contract calculates and issues an appropriate number of shares (wUSDM) to the depositor, based on the exchange rate between the deposited underlying tokens and the issued shares.

The exchange rate between the deposited tokens and the shares adjusts to reflect changes to USDM supply due to rebases (see equation below). Specifically, a positive rebase (reflected by an increase in the rewardMultiplier) results in an increase in the total value of USDM in the contract, prompting an upward adjustment of the exchange rate. Consequently, each share represented by wUSDM represents a greater quantity of the underlying token, reflecting the yield generated by Mountain Protocol. The price of wUSDM should be influenced by the markets perceived value of the asset. If each wUSDM represents a larger portion of USDM after a positive rebase, arbitrageurs can mint USDM or burn wUSDM using the contract to drive the price of wUSDM towards its intrinsic value.

Figure 2 below shows the token flow for users interacting with Mountain Protocol, specifically it illustrates how users can mint USDM and wrap their tokens for the non-rebasing price appreciating wUSDM stablecoin.

Figure 2 – Mountain Protocol Token Flow

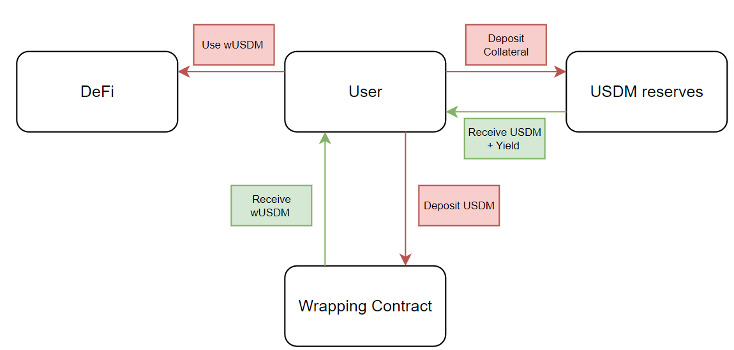

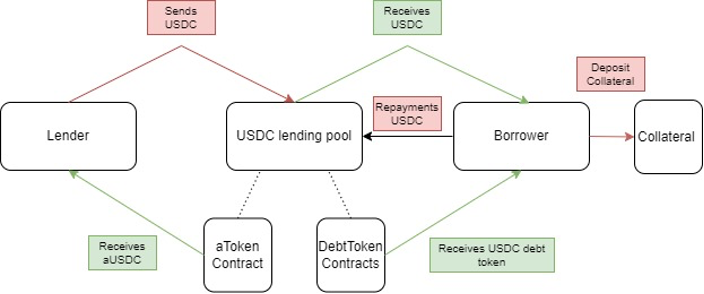

Aave Protocol – aTokens

Aave is an established DeFi protocol facilitating the lending and borrowing of crypto-assets. Users can lend their crypto-assets into Aave’s various lending pools to earn interest or post collateral and borrow crypto-assets from these pools. When a lender deposits crypto-assets into the lending pools they receive aTokens, which represent their share of the pool amount plus accrued interest.[14] For instance, depositing USDT into the pool results in the issuance of aUSDT. Aave supports various aToken stablecoins, such as aUSDT, aUSDC, and aDAI.

aTokens are interest bearing, however, unlike the previous example of Mountain Protocol’s USDM, the interest accruing to aTokens comes from interest payments made by borrowers into the pool rather than interest earned on the stablecoins reserves.[15] aTokens are also rebasing in the sense that the interest payments are distributed to aToken holders by increasing their wallet balance.[16] The underlying crypto-asset can be redeemed at any time when the lender decides to withdraw their crypto-assets from the lending pool.

To better understand this process, consider the following example alongside Figure 3 below. When a user deposits USDC into the lending pool, the protocol mints and issues the lender an equivalent amount of aUSDC at a 1:1 rate. For the user, these tokens are liquid and can be used in other on-chain activities, however, the user’s balance of aUSDC starts increasing every block as the pool composition of the pool changes through various user-initiated actions such as interest rate repayments.[17] After a while, once the lender decides to liquidate their position, they can burn this larger balance of aUSDC in exchange for a larger amount of USDC – representing the initial deposited principal plus the accrued yield over time.

Figure 3 – Aave Token Flow

On the other side of the coin, users who wish to borrow from the lending pool must first post collateral that exceeds the value of the amount they intend to borrow (see right hand side of Figure 3). The collateral must be in a crypto-asset supported by the protocol, and its required value is determined by the collateral ratio set for each asset. Borrowers have the option to choose between stable interest rates, which offer predictability in borrowing costs, and dynamic interest rates, which fluctuate based on the market demand and supply of the asset.[18] A borrower of USDC would receive both USDC and a debt token which represents the debt owed by the borrower to the protocol (including the principal and accruing interest on the loan).[19] Interest on the borrowed tokens accrues in real-time, however, interest payments can be made whenever, allowing borrowers to reduce their accrued interest and avoid liquidations. Interest payments are denominated in the same asset as the loan is made in and are directed to the lending pool, so a borrower of USDC makes interest payments in USDC.[20] Each time interest payments are made an equivalent value of the borrower’s debt tokens are burned, thereby reducing their overall debt commitment of their loan. Repayments made by borrowers also impact the pool’s asset composition which affects the interest rate earned by lenders reflected through their aToken balance.[21] The mechanics of how repayments impact yield earned by aToken holders is explained in the following paragraph.

The interest rate paid to aToken holders is maintained within Aave’s smart contracts through the liquidityIndex variable which tracks the cumulative interest earned by aToken holders over time.[22] While the source of the yield for aToken holders comes from payments made by borrowers, various interactions with a specific lending pool impact the value of its liquidityIndex.[23] These interactions are known as LendingPool methods and refers to user-initiated functions that affect the crypto-asset composition in the pool. These methods include functions relating to pool deposits, withdrawals, repayments and liquidations. Because these functions change the composition of the pools crypto-assets, they have a direct effect on its utilisation rate, which is defined as the ratio between borrowed and supplied crypto-assets in the pool. The utilisation rate is a key driver determining the interest rate charged to borrowers and earned by aToken holders.[24]

As explained previously, in Aave, yield is reflected by increasing the account balance of aToken holders. The balance of an aToken holder can be viewed by calling the balanceOf method which returns the current token balance associated with the aToken holder’s wallet. The balance is calculated based on the current block timestamp and the liquidityIndex and represents the aToken holder’s principal plus accrued interest. The design is similar to the rebasing mechanism used to update the accumulation of yield to Mountain Protocol's USDM holders, whereby yield is reflected by increasing holders account balances rather than actually transferring tokens to their wallets. Yield is realised by aToken holders when they initiate a withdrawal from the pool, which burns their (now larger) aToken balance in exchange for the original asset at a 1:1 ratio.[25]

Price Appreciating Stablecoins

Ethena Protocol - USDe & sUSDe

Ethena is a stablecoin protocol on Ethereum facilitating the issuance of its USDe stablecoin which is pegged 1:1 to the US Dollar and its interest accruing version – sUSDe. USDe is over-collateralised and can be minted by depositing allowed assets such as ETH, ETH LSTs or USDT into the protocol.[26]

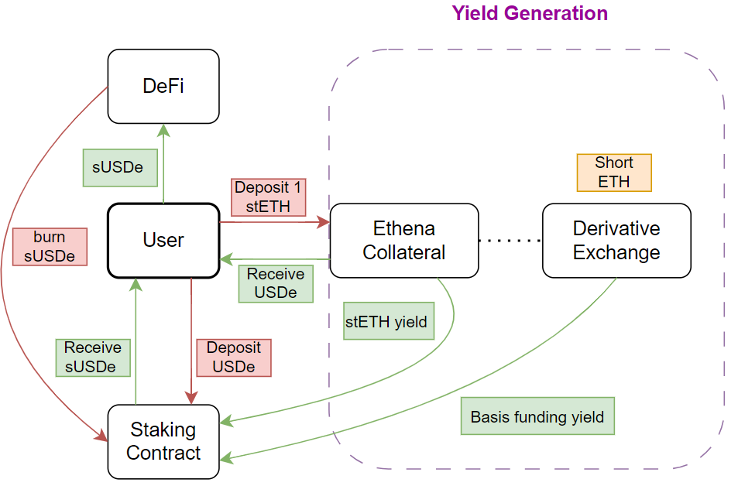

Ethena generates yield on its collateral deposits through two sources as illustrated in Figure 4 below.[27] Firstly, yield is derived from staked ETH, where the collateral assets, primarily in the form of LSTs such as stETH, earn consensus rewards. The second source of yield arises from the management of the protocol’s delta hedging derivatives positions. These positions exploit the funding and basis spread available in perpetual and futures markets, effectively leveraging the discrepancies in demand and supply within the market, along with historically positive baseline funding. For example, if a user mints USDe using stETH, the protocol opens a corresponding short position in ETH on derivative exchanges such as Binance or Bybit.[28] This creates a delta neutral position (meaning the protocol has no long or short exposure to the price of the crypto-asset) and allows Ethena to earn any positive funding rates on its trade position.[29]

Ethena Labs utilise both on-chain smart contracts and off-chain computations to manage its assets. The on-chain components are largely comprised of smart contracts that facilitate the minting and redemption of USDe and the staking of USDe for sUSDe. The off-chain components mainly relate to services that manage the delta hedging positions relative to the deposited collateral.[30]

When a user deposits a crypto-asset into Ethena’s minting contract, such as stETH, the crypto-assets are transferred from the minting contract to custody wallets. These addresses are part of a maintained list within the contract, ensuring that collateral assets can only move from the Ethena Minting contract to the whitelisted wallet addresses of Ethena's third-party Off-Exchange Settlement (OES) partners.[31] The process of updating or adding new OES addresses to the Ethena Minting contract is controlled by the admin address – a multi-signature wallet controlled by Ethena Labs.[32] Funds custodied by the OES partners are used as collateral on exchanges without the funds leaving the custody of the OES. This is achieved by mirroring the collateral in the OES wallets on exchanges to provide trading margin.[33] This allows Ethena to engage in delta-hedging trading activities, leveraging the liquidity on CEXs, while mitigating the risks associated with holding assets directly on these exchanges.

Ethena Labs utilises an internal hedging system to manage its trade positions. This system relies on a suite of off-chain application services designed to perform a multitude of functions related to risk management and trade execution. The process begins when a user initiates a deposit request. At this stage, Ethena’s servers conduct preliminary checks to verify the user's balance and assess whether the hedging system can accommodate the order. The servers also communicate with the designated OES wallet to prime it for the incoming deposit.[34] Upon successfully passing these checks, the process leverages an atomic mint function. This function simultaneously transfers the depositor's assets into the minting contract and mints an equivalent amount of USDe, which is then sent directly to the depositor's wallet.[35] The collateral is then transferred from the minting contract to the appropriate OES wallet.[36]

Using the crypto-assets custodied in the OES wallet, Ethena Labs open a short ETH position representing the equivalent value of the crypto-asset deposited as collateral.

To earn protocol yield from both baseline funding and ETH staking, holders of USDe need to stake their tokens in a specific staking contract (refer to the left-hand side of Figure 4 for details). This process is akin to how Mountain Protocol uses wUSDM within an ERC4626 Token Vault contract to allocate yield. In Ethena's case, staking USDe in its Token Value contract allows users to receive sUSDe, an interest-bearing version of USDe. Yield generated by the protocol is channelled into this staking contract in USDe by a dedicated address known as the Rewarder Role.[37] This role is assigned at the time the Ethena Smart Contracts are deployed and can be altered by the Default Admin Role, controlled by multi-signature wallet representing one of the highest levels of authority over Ethena’s smart contracts[38].

Since sUSDe represents shares of the USDe in the Vault, as protocol yield in the form of USDe increases the asset base in the Vault overtime, the value of sUSDe appreciates. When users decide to un-stake sUSDe, they receive an equivalent value of USDe in exchange which representing both their original staked amount but also their proportional share of the accrued protocol yield.

Figure 4 – Ethena Protocol (Simplified) Token Flow

Kelp DAO – rsETH

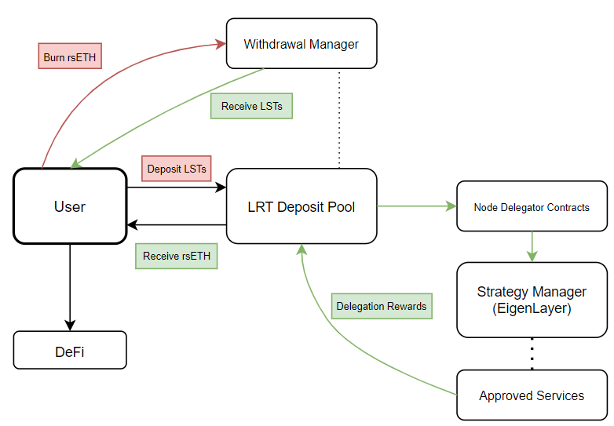

While the previous examples focused on stablecoins pegged to the US Dollar, stablecoins can theoretically peg their price to any external reference, including other crypto-assets. For instance, Liquid Re-staked Tokens (LRTs) aim to mirror the value of liquid staked tokens (LSTs) like rETH or stETH. To be clear, LSTs can be classified as interest bearing stablecoins themselves as their price reflects the value of the underlying staked asset plus yield from consensus rewards. Consequently, the value of LRTs not only reflects the price of the underlying LST, which includes the price of the native token and its yield but also includes additional yield earned from staking LRTs themselves. To illustrate this concept, let's look at Kelp DAO and the specific example of rsETH as illustrated in Figure 5 below.

Kelp DAO is a liquid re-staking provider facilitating the issuance of an LRT known as rsETH.[39] The protocol allows users to deposit ETH and various ETH LSTs such as stETH or ETHx and mint rsETH in return. rsETH is claimed to represent fractional ownership of the protocols underlying LSTs and provides LST holders with a solution to liquidity locked in protocols like EigenLayer.[40]

From a depositor’s perspective, the process of acquiring rsETH is initiated by depositing ETH or an ETH LST into the Deposit Pool smart contract by calling either the depositETH or depositAsset functions respectively.[41] These functions operate similarly by performing several checks to ensure that the deposited crypto-asset can be accepted, such as checking whether the contract is paused and whether the deposited amount exceeds the protocols deposit limit. If the checks are passed, the functions calculates the amount of rsETH to be exchanged and calls an internal mint function which sends the newly minted rsETH to the depositor’s address.[42] Assets in the deposit pool are transferred to various node operator contract addresses through the transferETHToNodeDelegator and transferAssetToNodeDelegator functions depending on whether the crypto-asset is ETH or an LST respectively.[43] These functions can only be called by the LRT manager address managed by a multi-signature wallet.[44] The LRT manager address can be changed by the admin address initialised during the deployment of the KelpDAO smart contracts. Assets in the Node Delegator contracts are allocated to various strategies such as the EigenLayer staking strategy through the depositAssetIntoStrategy function, which again can only be called by the LRT manager address.[45] At this point the transferred crypto-assets are managed by EigenLayer smart contracts and delegated as re-staked assets to node operators. Node operators use the re-staked LSTs to secure various approved services (such as sidechains and data availability layers) and earn additional yield for doing so.[46]

LSTs in the Deposit Pool are distributed among various node operators whitelisted by Kelp DAO. These node operators earn rewards for providing validation services for external networks (for more information see BCAS’ article “Introduction to EigenLayer”) and these rewards accrue back from EigenLayer into the Deposit Pool contract.[47] The process is facilitated by the LRT manager by calling the transferBackToLRTDepositPool function, which channels assets from the Node Delegator contract back to the Deposit Pool contract. Notably, when the LRT manager deposits yield into the Deposit Pool, it doesn't trigger the minting of new rsETH, this is unlike the process for user deposits whereby rsETH is minted in exchange for the deposited asset. This nuance is important as this preserves and increases the overall value of the pool as represented by rsETH. Because rsETH represents shares of ownership in the pool, its value increases over time as the asset base in the Deposit Pool contract grows due to accrued rewards, leading to an increase in the price of rsETH.

While withdrawals on Kelp DAO aren’t currently enabled,[48] the process for exchanging rsETH for the underlying assets will be conducted in-part through the withdrawal manager smart contract. Details on which asset or combination of assets the withdrawal request will be settled in have not yet been revealed.[49]

Figure 5 – KelpDAO Token Flow

Moving on to the legalities under MiCA

How are stablecoins regulated under MiCA?

We’ll be starting off with a refresher on stablecoins under MiCA, which consist of two separate and distinct categories: E-Money Tokens (EMTs) and Asset-Reference Tokens (ARTs).

Starting off with EMTs, these are defined as “a type of crypto-asset that purports to maintain a stable value by referencing to the value of one official currency”. An “official currency” is then defined as “an official currency of a country issued by a central bank or other monetary authority”. In essence, therefore, any crypto-asset that is designed to maintain a stable value by referencing to a fiat currency issued by a recognised central bank or other monetary authority will be classified as an EMT. Prime examples of EMTs are Tether’s USDT and Circle’s EUROC, with the latter being an EMT that references the value of an official currency of an EU Member State, being the Euro.

ARTs are then defined as follows: “a type of crypto-asset that is not an electronic money token and that purports to maintain a stable value by referencing to any other value or right or a combination thereof, including one or more official currencies”. Firstly, and by exclusion, ARTs are crypto-assets that are not EMTs, so automatically all single-fiat-pegged stablecoins are excluded as they would classify as EMTs. Crypto-assets that are designed to maintain a stable value by referencing to any other asset, including crypto-assets, are likely to classify as ARTs. This includes wrapped tokens such as Wrapped ETH (wETH), since it is designed to maintain a peg to ETH.

It is fundamentally important to note that the composition of, or the manner in which reserves are maintained is immaterial to the classification of the crypto-asset per se. The composition and maintenance of reserves are to be seen as obligations on the issuer of the ART/EMT as the case may be, provided that such issuer falls within the scope of MiCA. If, for instance, an EMT such as EUROC loses its peg and falls below the value of 1 Euro per 1 EUROC, this does not automatically mean that it is no longer an EMT; rather, what it means is that the issuer is potentially in breach of MiCA. The only criterion that matters for classification is whether the crypto-asset purports to maintain a stable value by referencing either one official currency, or any other asset, in order for it to be classified as either an EMT or ART.

Granting interest on stablecoins (EMTs/ARTs)

The granting of interest on stablecoins is restricted under MiCA. Interest is interpreted in a wide manner, and can consist of any remuneration or any other benefit related to the length of time during which a holder of EMTs/ARTs holds such EMTs/ARTs. It shall also include net compensation or discounts, with an effect equivalent to that of interest received by the holder of EMTs/ARTs, directly from the issuer or from third parties, and directly associated to the EMTs/ARTs or from the remuneration or pricing of other products[50].

The prohibition of interest is specifically imposed in relation to the issuers of EMTs/ARTs, and in relation to the crypto-asset service providers (CASPs) that provide crypto-asset services related to EMTs/ARTs. In the case of CASPs, the prohibition is absolute, in the sense that there are no exemptions to avail of – they cannot offer interest in relation to any EMT/ART, regardless of whether that EMT/ART was issued in the EU or otherwise, or whether the EMT/ART was issued by an identifiable issuer or otherwise.

In the case of issuers of EMTs/ARTs which cannot be identified, it is worth noting that such issuers are exempted from abiding by Titles III and IV of MiCA, being the Titles that regulate ARTs and EMTs respectively. This means that such issuers can, by inverse interpretation, grant interest on EMTs and ARTs. For further information on issuers and when they are, or are not, required to obtain regulatory approval under MiCA, please check our article penned two years ago on the subject.

Any other person who is not the issuer of the EMTs/ARTs in question, or which is not a CASP, seems to have no restriction or prohibition in granting interest on EMTs/ARTs. This makes the structuring of DeFi protocols a critical task in ensuring that any yield or interest is not being granted by the issuer (directly or indirectly); if the yield or interest is being generated through borrowing and lending activities partaken by the users of a protocol without any intervention by the issuer, for instance, this would likely not be captured under MiCA.

Assessing the four sample stablecoins

Before commencing the assessment of the four stablecoins, it is important to note the following disclaimers:

- The assessments below are not to be treated, in any way, form or shape, as anything akin to or resembling a legal opinion or a memo. Such assessments are indicative, and solely undertaken for educational purposes.

- The assessments are performed solely on the tokens/crypto-assets, and shall not enter into the merits of the business model or related entities, if any, including whether crypto-asset services or other regulated services are being provided.

- The assessments are made solely under MiCA, and not in relation to any other legislative acts or frameworks.

- An assumption shall be taken that the issuers of all four stablecoins are identifiable.

- The assessments are made on the basis of third-party information that is publicly available. No guarantees are provided on the veracity or authenticity of such information.

1. Mountain Protocol’s USDM & wUSDM

USDM

USDM is a rebasing ERC-20 crypto-asset which purports to maintain a stable value by referencing the US Dollar, likely making it an EMT. It is fully redeemable, at a one-to-one ratio, for the equivalent of 1 US Dollar in USDC[51], and can be redeemed anytime by the user except in the case of “large redemption flows”[52]. The reserves are overcollateralised, and fully held in financial instruments that mainly consist of short-term US treasuries, with other instruments being money market funds investing in short-term US treasuries, treasury ETFs and reverse purchase agreements collateralised with US treasuries[53].

Incidentally, the composition of reserves makes USDM almost aligned with the requirements under MiCA for EMTs, since the reserves are being invested in highly liquid financial instruments as allowed under Article 54(b). However, there are some points docked in certain areas; for example, none of the reserves are held in funds deposited in separate accounts in credit institutions, a key requirement for EMT reserves since at least 30% must be held in such manner.

However, the main purpose of this article is the interest-bearing element of stablecoins. In the case of USDM, interest earned on its reserve assets is reflected on-chain though the rewardMultiplier variable and is updated daily by calling the addRewardMultiplier function. As denoted in the technical section above, the addRewardMultiplier function updates the yield daily based on a pre-determined rate, and it is important to note that this is a permissioned function that is only accessible through a wallet address controlled by the Mountain Protocol team[54]. The Mountain Protocol team also manages the Mint function which can create and assign new USDM tokens, effectively making it the issuer of USDM since the definition of an ‘issuer’ under MiCA is simply defined as ‘a natural or legal person, or other undertaking, who issues crypto-assets’, with the issuer being an entity that has control over the creation of crypto-assets[55].

Since issuers are prohibited from offering interest on EMTs under Article 50, the retention of control over the addRewardMultiplier function by the Mountain Protocol team may prove to be problematic. Even if Mountain Protocol Limited, as a legal entity, were to obtain a licence as an EMI or credit institution, it would still not be able to grant interest on or in relation to USDM.

wUSDM

While USDM itself, as the rebasing token with its value pegged 1:1 to the US Dollar, is likely to be seen as an instrument of payment due to its likely classification as an EMT, wrapped USDM (wUSDM) is non-rebasing since it ‘integrates’ the shares element and therefore, as a result, cannot be pegged to the US Dollar as it intrinsically accrues yield through price appreciation.

It is important to note that if crypto-assets purport to refer their value to any other asset, value or right, including what can loosely be termed as an underlying net asset value that includes generated yield, then the crypto-asset is likely to classify as an ART. Given that wUSDM’s initial value was 1 US Dollar, and it is deriving its value from that base amount plus the yield accrued from the underlying reserve assets, then it is plausible to conclude that wUSDM exhibits qualities that make it seem more of an ART, given that it refers its value to one official currency, being the US Dollar, in conjunction with the value of the generated yield.

As in the case of USDM, if the yield or interest is being granted, directly or otherwise, by the issuer via control over the addRewardMultiplier function, then this would effectively be prohibited under MiCA.

2. Aave Protocol’s aTokens

Aave’s aTokens are rebasing crypto-assets that represent the tokens deposited by lenders into lending pools, with the yield accruing to aTokens from interest payments made by borrowers. Since the aTokens are minted depending on the crypto-asset deposited by the lender, they maintain a stable value to the deposited crypto-asset, so the classification of an aToken depends on the nature of the deposited crypto-asset. If the crypto-asset deposited by the lender qualifies as a crypto-asset that is captured within MiCA, then it is likely that the aToken itself classifies as an ART, since it is referring its value to the value of another crypto-asset.

Taking a step back so as to encompass the wider picture, these are the three crypto-asset categories regulated under MiCA:

- ARTs

- EMTs

- Any other crypto-asset which is not a financial instrument or other excluded crypto-asset (including crypto-assets that are unique and not fungible)

BTC and ETH are prime examples of the third category listed above. If a lender deposits ETH and receives aETH, aETH is likely to be an ART. Likewise, if a lender deposits USDC, which is an EMT, and receives aUSDC, aUSDC is likely to be an ART.

Why is a crypto-asset referencing an EMT classified as an ART, and not an EMT?

It’s important to make this parenthesis of an argument as there is the general misconception that if a crypto-asset is pegged to an EMT, then it likewise should be classified as an EMT. Care must be taken in such instances, as it is clear that a crypto-asset only classifies as an EMT if it purports to refer to the value of one official currency. An EMT such as USDT or USDC is not an official currency – it’s a crypto-asset, and it is not issued by a central bank or other monetary authority. If a crypto-asset purports to refer to the value of another crypto-asset, then it is an ART, since an ART is a) not an EMT and b) it is designed to maintain its peg by referring to the value of any other asset, including a crypto-asset.

So, back on to aTokens – what are the general implications?

As in the case for EMTs, interest cannot be granted on ARTs by the issuer or a CASP offering services in relation thereto. While aTokens differ from USDM in one particular crucial aspect, as interest accruing to aTokens is generated from the interest payments made by borrowers, it is likely that, for the purpose of the specific assessment relating to the prohibition of interest, the source of the yield does not matter as much as who is in control of granting the yield, as we shall be seeing shortly.

Article 40(3) may cast some doubt on whether the source of yield/interest matters, since the legislator states that interest includes “net compensation or discounts, with an effect equivalent to that of interest received by the holder of asset- referenced tokens, directly from the issuer or from third parties, and directly associated to the asset-referenced tokens or from the remuneration or pricing of other products”. However, the same sub-article 3 starts with the words “for the purposes of paragraphs 1 and 2”, which strictly and solely make reference to issuers and CASPs only in terms of prohibiting them from granting interest.

Who, or what, is granting interest on aTokens?

The design of Aave’s smart contracts is structured in such a way that interest rates depend on the utilisation of each pool; interest is always received by asset lenders, so long as someone is borrowing from that pool. Without any borrowers, there would be no source of interest payment. However, without the Aave protocol itself, even if there are borrowers, there would be no interest payment received by the lenders, or at least not in such a fluid and seamless manner, being the cornerstone of innovation that DeFi brings to the table.

As established in the technical section further above, the interest rate paid to aToken holders is maintained within Aave’s smart contracts through the liquidityIndex variable which tracks the cumulative interest earned by aToken holders over time[56]. Various user interactions with Aave lending pools (Lending Pool Methods), change the composition of the pools crypto-assets and these interactions impacts the value of the liquidityIndex variable. Account balances of aToken holders are updated every block, based on the current block time and the value of the liquidityIndex variable. Therefore, the rate of interest granted to the aToken holders is effectively paid out thanks to this key variable, naturally in conjunction with the host of lending pool methods (user initiated functions calls) which impact the liquidityIndex .

While the source of the yield for aToken holders comes from interest repayments made by borrowers, a range of user-initiated Methods, such as pool deposits, withdrawals, borrows, and liquidations impact the liquidityIndex variable influencing the overall yield paid to lenders though balance changes in their aToken holdings[57]. Aave’s smart contracts architecture therefore plays a pivotal role not only in the determination of the rate of the yield accruing to lenders, but also provides the technical architecture facilitating the granting of yield to aToken holders.

Any person/s exercising control over functions that impact the value of the liquidityIndex variable could potentially be seen as the person/s granting interest, or affecting the interest being granted. However, as long as such person/s are a) not the issuer of aTokens or b) a CASP, then this should not be of material significance under MiCA. If, however, the minting function is also controlled by the same person/s controlling key functions that impact the liquidityIndex variable (such as deposits, withdrawals and liquidations), then this may pose an issue, depending on the extent and parameters of such control which would be important in determining whether the ‘issuer’ definition is being met or otherwise.

3. Ethena Protocol’s USDe & sUSDe

USDe seems to be an overcollateralised EMT, minted through the deposit of assets such as ETH Liquid Staking Tokens (LSTs) by the user. However, no interest is granted in relation to USDe. In order for the user to access the interest generated by the Ethena Protocol, they must deposit USDe in the staking smart contract in order to receive sUSDe through atomic swapping. At the launch of the Ethena Protocol, sUSDe was initially issued at a 1:1 value to USDe, but sUSDe is expected to appreciate in value as the yield generated by the Ethena protocol is transferred into the staking smart contract[58].

In other words, yield is not paid directly to the sUSDe holder, but it accumulates within the staking smart contract. sUSDe effectively represents the user’s share of the assets being staked in the relevant smart contract. It is important to note that the term share does not seem to denote ownership rights, but is simply being used in faithful reflection of the correct technical term.

How is the yield being generated?

The yield is generated from two sources: a) the yield derived from the deposited LSTs, and b) the management of the protocol’s delta hedging derivative positions i.e. the funding and basis spread from such positions. Ethena Labs, on behalf of the Ethena Protocol, opens a short position concurrently with the minting of USDe by the user, ensuring that the value of the short position corresponds to the underlying value of the collateral received. When a user conversely claims USDe for the underlying collateral, Ethena Labs closes the corresponding dollar value of the short position.

With the yield accruing in the staking smart contract, and the users’ stake in such contract represented through sUSDe, it is clear that sUSDe is not an EMT. As in the case of wUSDM, its initial value was at par with USDe, ergo 1 US Dollar, but its appreciation in value due to yield accrual in the staking smart contract means that its value is not only derived, albeit initially, from reference to USDe, but it is also deriving its value from the yield accrued in the staking smart contract. This points towards sUSDe being more prone towards classification as an ART, with the value referred from one official currency (USD) combined with the value of the yield accrued in the staking smart contract.

Does the prohibition of interest apply in relation to sUSDe?

Tracking the channelling of the yield further leads to the Rewarder Role, controlled by a dedicated address which channels yield generated by the protocol to the staking contract, ergo the ERC-4626 Token Vault contract. The Rewarder Role seems to still be assigned to the Gnosis Safe multisig that holds original control of all smart contracts within the Ethena protocol[59], with such control possibly including Ethena Labs, in whole or in part.

If the Rewarder Role is indeed ultimately controlled, even partially, by Ethena Labs or otherwise the same person who meets the definition of ‘issuer’ in relation to USDe or sUSDe, then the prohibition of interest may well be applicable.

4. Kelp DAO’s rsETH

In line with the recent hype around Liquid Restaking Tokens (LRTs), we are also covering rsETH, a crypto-asset that purports to refer its value to the value of the underlying LSTs deposited by users of the Kelp DAO protocol plus the yield that has been generated through restaking the LST.

While LSTs are generally interest-bearing stablecoins, LRTs not only capture the yield generated by the LSTs from the consensus rewards on Ethereum, but also the additional yield generating through restaking on other protocols via EigenLayer. The generated yield accrues to the Deposit Pool, with the value of rsETH appreciating over time as the rewards/yield accumulate. Similarly to the other non-rebasing crypto-assets covered above, rsETH’s value commences at roughly the same price of the assets which are deposited and held in the Deposit Pool, with the value of rsETH expected to appreciate against the underlying LSTs as yield accrues in the pool. This indicates that rsETH’s value is initially derived from the weighted average value of the deposited LSTs, combined with the value of the accrued yield, likely making it an ART.

Interestingly, the documentation of Kelp DAO states that rsETH “indicates fractional ownership of the underlying assets”, being the pooled LSTs[60]. Care should be taken in using terms that indicate ownership, fractional or otherwise, of any underlying assets, since in the words of the European Securities & Markets Authority’s (ESMA) words, “a direct ownership right might be complex or undesirable for investors”[61], and with good reason – ownership rights may be indicative of the instrument, including a crypto-asset, being potentially seen as a transferable security. It is perhaps the only time where it is best to own nothing, and as a result be happy.

Are there any implications for the generation of yield in rsETH?

The yield generated in the Deposit Pool is primarily derived from the delegation rewards generated by the node operators which accrue back into the Deposit Pool. At first glance, it may seem as if the node operators are granting the yield per se, but even if that were the case, node operators solely performing validator functions do not classify as CASPs under MiCA since they are not providing any of the listed crypto-asset services.

However, node operators do not grant yield or interest – in such scenarios, the yield is captured through the efforts of the person(s) who develop the architecture that ‘diverts’ the rewards into a smart contract which collects the yield for distribution to the holders of the relevant crypto-asset.

The key address in this case is the LRT manager address managed by a multi-signature wallet[62], which controls critical functions such as the depositAssetIntoStrategy function and the transferBackToLRTDepositPool function. With such functions, including the minting function, being assigned and controlled to the same LRT manager address, then given such centralised control it may be seen as the granting of interest by the issuer/s of the crypto-asset, which would be prohibited under MiCA.

Conclusion

This has proven to be one of the most complex articles to write to date, despite it being at a prima facie level when compared to the depth we normally go to when making assessments privately. It is safe to say that interest or yield bearing stablecoins can be fraught with technical complexities just as much as legal ones.

While the prohibition of interest under MiCA is restricted vis-à-vis issuers and CASPs, the implications for both are conversely to be interpreted widely, as the intention of the legislator is to clamp down on the granting of interest in relation to crypto-assets that aim to hold a stable value. Separating the issuer from the person(s) that hold control over the granting of interest is of crucial importance, and the evergreen question of “Who is granting the yield?” plays a key role in determining whether interest in relation to the EMT or ART in question can be granted or otherwise.

However, the granting of interest per se only plays a secondary role to the vital and fundamental importance of crypto-asset classifications, and when structuring such complex assets as interest-bearing stablecoins, care must be taken that such do not inadvertently side-step MiCA only to potentially fall within purview of other legislative instruments, including MiFID II and the AIFMD.

[1] https://coinmarketcap.com/view/stablecoin/

[2] https://ethena-labs.gitbook.io/ethena-labs/alternatives-existing-stablecoins

[3] However, some stablecoins serve as an inflation hedge by tracking the value of an asset at a certain point in time. For instance, AmpleForth’s AMPL stablecoin is pegged to the 2019 CPI adjusted dollar. https://www.ampleforth.org/

[4] https://data.ecb.europa.eu/main-figures/ecb-interest-rates-and-exchange-rates/key-ecb-interest-rates

[5] https://docs.mountainprotocol.com/reference/usdm-reserves

[6] https://docs.mountainprotocol.com/reference/usdm-reserves

[7] https://docs.mountainprotocol.com/reference/mountain-protocol-platform

[8] https://docs.mountainprotocol.com/reference/usdm-token

[9] https://github.com/mountainprotocol/audits/blob/main/OpenZeppelin%20Mountain%20Protocol%20USDM%20-%20Audit%20Report%20Jun%202023.pdf pg. 4

[10] https://docs.mountainprotocol.com/reference/usdm-token

[11] https://github.com/mountainprotocol/tokens#wUSDM

[12] https://docs.mountainprotocol.com/reference/usdm-token

[13] https://ethereum.org/en/developers/docs/standards/tokens/erc-4626/

[14] https://docs.aave.com/developers/tokens/atoken

[15] https://docs.aave.com/risk/liquidity-risk/borrow-interest-rate

[16] https://docs.aave.com/developers/tokens/atoken

[17] https://docs.aave.com/developers/tokens/atoken

[18] https://docs.aave.com/developers/guides/rates-guide#supply-and-borrow-rates

[19] https://docs.aave.com/developers/v/2.0/the-core-protocol/debt-tokens

[20] https://docs.aave.com/faq/borrowing

[21] https://docs.aave.com/developers/tokens/atoken

[22] https://docs.aave.com/developers/v/2.0/glossary

[23] https://docs.aave.com/developers/tokens/atoken

[24] https://docs.aave.com/risk/liquidity-risk/borrow-interest-rate

[25] https://docs.aave.com/developers/tokens/atoken

[26] “How to Mint | Ethena”, https://www.youtube.com/watch?v=DK_fq3JqalM&t=3s

[27] https://ethena-labs.gitbook.io/ethena-labs/solution-overview/yield-explanation

[28] https://ethena-labs.gitbook.io/ethena-labs/solution-overview/usde-overview

[29] https://ethena-labs.gitbook.io/ethena-labs/solution-overview/usde-overview/delta-neutral-stability

[30] https://ethena-labs.gitbook.io/ethena-labs/solution-design/overview

[31] https://ethena-labs.gitbook.io/ethena-labs/collateral-custody-and-security/overview

[32] https://ethena-labs.gitbook.io/ethena-labs/solution-design/minting-usde/mint-and-redeem-key-functions

[33] https://ethena.notion.site/Ethena-FAQs-3ccc1437e13343f8b74c0d005e4f5128 - Custody Solutions

[34] https://ethena-labs.gitbook.io/ethena-labs/solution-design/minting-usde

[35] https://ethena-labs.gitbook.io/ethena-labs/solution-design/minting-usde/order-validity-checks

[36] https://ethena-labs.gitbook.io/ethena-labs/solution-design/minting-usde

[37] https://ethena-labs.gitbook.io/ethena-labs/solution-design/staking-usde/staking-key-functions

[38] https://github.com/code-423n4/2023-10-ethena

[39] https://kelp.gitbook.io/kelp

[40] https://kelp.gitbook.io/kelp

[41] https://etherscan.io/address/0xd4114da917c9266e857113e56815a8c6759f97df#code

[42] https://etherscan.io/address/0xd4114da917c9266e857113e56815a8c6759f97df#code

[43] https://etherscan.io/address/0xd4114da917c9266e857113e56815a8c6759f97df#code

[44] https://kelp.gitbook.io/kelp/rseth-smart-contracts

[45] https://github.com/code-423n4/2023-11-kelp/blob/main/src/NodeDelegator.sol

[46] https://docs.eigenlayer.xyz/eigenlayer/overview/key-terms

[47] https://kelp.gitbook.io/kelp/technical-architecture

[48] https://www.kelpdao.xyz/restake/

[49] https://kelp.gitbook.io/kelp/technical-architecture

[50] Articles 30 & 40, MiCA

[51] https://docs.mountainprotocol.com/

[52] https://docs.mountainprotocol.com/legal/terms-and-conditions

[53] https://docs.mountainprotocol.com/reference/usdm-reserves

[54] https://github.com/mountainprotocol/audits/blob/main/OpenZeppelin%20Mountain%20Protocol%20USDM%20-%20Audit%20Report%20Jun%202023.pdf

[55] MiCA, Recital 20

[56] https://docs.aave.com/developers/v/2.0/glossary

[57] https://docs.aave.com/developers/tokens/atoken - See FAQ

[58] https://ethena-labs.gitbook.io/ethena-labs/video-guides/how-to-stake-usde

[59] https://github.com/code-423n4/2023-10-ethena

[60] https://kelp.gitbook.io/kelp

[61] Consultation Paper on the draft Guidelines on the conditions and criteria for the qualification of crypto-assets as financial instruments (ESMA), point 36, pg. 11, 29 January 2024 < https://www.esma.europa.eu/sites/default/files/2024-01/ESMA75-453128700-52_MiCA_Consultation_Paper_-_Guidelines_on_the_qualification_of_crypto-assets_as_financial_instruments.pdf>

[62] https://kelp.gitbook.io/kelp/rseth-smart-contracts