This report has been co-authored by Vincenzo Furcillo, Senior Research Associate at BCAS, and Tom Berkman, Technical Analyst at BCAS.

Reader Disclaimer: Data Limitations

This report presents an analysis of the stablecoin market, primarily based on data compiled and assessed up to specific cut-off dates. It is important for readers to note the following constraints regarding the data used in this report:

- General Market Data: The figures and insights relating to the overall stablecoin market include data up to and including November 1st,

- Transaction-Based Analysis: The analysis focusing on transactions within a sample of stablecoins is based on data collected up to October 1st, 2023.

While this report endeavours to offer a thorough snapshot of the stablecoin market during Q4 2023, readers should be aware that the cryptocurrency and stablecoin markets are subject to rapid and significant changes. As such, the information and analyses presented in this report may not fully reflect the current state of the market. Developments and trends emerging after the aforementioned cut-off dates are not covered in this report.

Contents

1.1 Stablecoins – A General Overview

2.1.3 Real-World Assets (RWAs)

2.3.1 Decentralised Governance

3.1 Proxy Contracts, Pausing & Shutdowns

3.4 Minting and Burning of Tokens

Executive Summary

This comprehensive report delves into the $126 billion-dollar stablecoin market by examining the 50 largest stablecoins by market capitalisation. A taxonomy is presented to classify stablecoins based on pivotal attributes such as collateral type, peg, stabilisation mechanisms and governance structure. This classification reveals the multifaceted nature of stablecoins and highlights the many different types and designs of stablecoins prevalent in the market today.

An in-depth analysis is conducted on a sample of 10 stablecoins by examining their smart contracts and focusing on contractual arrangements, ownership structures, and transaction checks. Findings from this examination suggest a prevalent trend: centralised stablecoins demonstrate a propensity towards employing proxy contracts and enacting more stringent transaction checks compared to their decentralised counterparts.

Moreover, the report quantitatively assesses the financial repercussions stemming from the design choices of stablecoins. It reveals significant expenditures associated with transaction checks, amounting to approximately $100 million for USDT and $87 million for USDC, outpacing other stablecoins in the sample. These figures are attributed to the high transaction volumes these stablecoins experience. By analysing historical transaction data, we calculate the average transaction cost, and the corresponding expenses related to transaction checks for each stablecoin.

In conclusion, this report presents a detailed examination of the stablecoin landscape, shedding light on the complexity of stablecoin architecture, the economic implications of their utilisation, and the consequent evolution of the stablecoin market over time.

1 Introduction

1.1 Stablecoins – A General Overview

Stablecoins are a form of digital currency designed to maintain parity with an external benchmark, often a sovereign currency (for instance, the US Dollar) or a physical commodity (such as gold). Unlike other cryptocurrencies which are known for their volatility, stablecoins aim to maintain price stability. They achieve this stability through strategic design features such as collateral backing and dynamic supply adjustments.

The primary purpose of stablecoins is to perform the fundamental roles of fiat money within cryptocurrency ecosystems. They act as a medium of exchange, a store of wealth, and a unit of account, thereby facilitating transactions in cryptocurrency networks. As of the current date, stablecoins reached a market capitalisation of roughly $126 billion, representing over 10% of the total market capitalisation of all cryptocurrencies.[1]

Tether USD (USDT) was the pioneering stablecoin and remains the largest. With a market capitalisation of nearly $85 billion, USDT commands a dominant market share, constituting over two-thirds of the total stablecoin market.[2] Launched in 2014 by iFinex, the parent entity of the Bitfinex exchange, USDT emerged as a solution to the challenges faced by cryptocurrency investors to access traditional banking services such as fiat deposits and withdrawals on exchanges. By introducing a digital equivalent of the US dollar, USDT bridged the gap between the traditional banking system and cryptocurrency markets.

The success of USDT triggered widespread adoption and led to its prominent listing as a major trading pair on numerous exchanges.[3] Recognizing the value and demand for stablecoins, other well-established exchanges, including Binance and Coinbase, followed suit and launched their Centre consortium, a partnership between Circle and Coinbase, in September 2018, while Binance USD (BUSD) made its debut through Binance in September 2019.

These exchange-issued stablecoins continue to dominate the market, collectively accounting for over 85% of the stablecoin market (see Figure 1 below).

Figure 1. Market share of top 50 stablecoins by market capitalisation

However, in recent years, there has been a significant surge in the number of stablecoin offerings with many newer stablecoins incorporating unique designs to differentiate themselves from the rest.

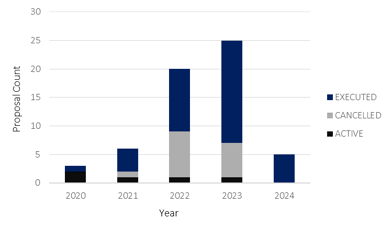

Figure 2. Number of stablecoins issued per quarter

Figure 2 shows the number of issued stablecoins (that are still in the top 50 by market capitalisation) in each quarter since the release of USDT in 2014.

Stablecoins can generally be categorised into five main groups based on the asset type backing them: fiat-backed, commodity-backed, real-world asset (RWA) backed, crypto-backed, and algorithmic (no backing). While a comprehensive taxonomy of stablecoins is provided in Section 2, a brief introduction is given here.

The predominant subset of stablecoins comprises those underpinned by fiat currency reserves. These stablecoins are typically pegged on a one-to-one basis to the respective currencies that back them.[4] Notable examples, including USDT, USDC, and BUSD,5[5] are frequently traded on leading exchanges. For stablecoins in this category, issuers receive fiat deposits from clients and reciprocally mint an equivalent amount of stablecoins, with the received currencies serving as collateral.[6] For each unit of stablecoin issued, a corresponding unit of fiat currency – for example, US Dollars (USD), Japanese Yen (YEN), or Euros (EURO) – is maintained in reserve, thus underpinning the stablecoin's value and ensuring its convertibility at parity.

Commodity-backed stablecoins form the second category within the stablecoin ecosystem, operating similarly to fiat-backed stablecoins. The distinct characteristic of these stablecoins, however, is that their value is not pegged to a fiat currency, but to a tangible commodity, typically precious metals like gold. Noteworthy examples in this domain are Tether Gold (XAUT) and Paxos Gold (PAXG), which peg their value to the current market price of gold. In lieu of accepting fiat currency deposits, issuers of commodity-backed stablecoins maintain a physical reserve of the commodity in question. These reserves are securely stored and audited to provide assurance that each digital token issued is indeed backed by a defined amount of the commodity, establishing trust in the token's value and redeemability.

Newer stablecoins are innovating by incorporating Real-World Assets (RWAs) as a collateral base. This approach involves the tokenisation of inherently stable assets, such as treasury bills,

allowing stablecoins to capitalise on high-interest-rate environments. A prime example of this trend is MakerDAO's DAI stablecoin. Following the implementation of a governance proposal in June 2021,[7] DAI has started to diversify its collateral portfolio to include RWAs, namely treasury bills and bonds.

The fourth category includes stablecoins collateralised by other cryptocurrencies. An example is Synthetix's Synthetic USD (sUSD). Similar to DAI, sUSD is pegged to the US dollar; however, it is supported by a pool of reserve cryptocurrencies held within the Synthetix network. To ensure price stability despite the volatility inherent in its collateral, sUSD relies on an over-collateralisation model. This requires the value of the reserves to exceed the total value of circulating sUSD tokens, creating a buffer to absorb market fluctuations and maintain its peg to the US dollar.[8]

Finally, the last category encompasses algorithmic stablecoins, which instead of traditional collateral derive their stability from algorithms written in smart contracts and complemented by economic incentives to maintain their peg. FRAX and TerraUSD (UST) are notable examples that have historically populated this category. It is critical, however, to acknowledge the inherent challenges and potential risks associated with stablecoins in this category. The most salient case is that of TerraUSD (UST), which, despite its historical popularity, lost its peg in May 2022 and subsequently declined to trade below one cent, necessitating a rebrand of the stablecoin to Terra Classic USD (USTC). The downfall of UST illustrated the potential vulnerabilities of algorithmic stablecoins in maintaining stability.[9] In response to the collapse of UST, the FRAX community decided to restructure their stablecoin and transition to a fully collateralised model.[10] Currently, the market for algorithmic stablecoins has contracted, with remaining projects commanding significantly lower market capitalisations in comparison to their collateral-backed counterparts, reflecting heightened market caution and a recalibration of trust in such mechanisms.

Table 1 below summarises the 50 stablecoins analysed in this report by collateral type.

Table 1. Market capitalisation and number of stablecoins in the top 50 by collateral type [11]

1.2 Report Aims and Structure

The intention of this report is to provide the reader with a comprehensive understanding of the stablecoin market, the contractual design of significant stablecoin and an appreciation for the cost of transacting stablecoins. Specifically, the report covers the following three areas:

-

Section 2: A Taxonomy of Stablecoins – This section provides a framework to categorise the various types of stablecoins. Stablecoins are analysed from a variety of perspectives including collateral type, peg, stabilisation mechanisms and Based on this taxonomy, a sample of stablecoins is selected and further analysed in Section 3 and Section 4.

-

Section 3: Contract Analysis – This section examines the smart contracts for the sample of stablecoins selected from the taxonomy. A comprehensive analysis is conducted on the contractual framework, ownership structure, and operational control mechanisms for each stablecoin.

-

Section 4: Transaction Costs – Building on the smart contract design discussed in Section 3, this Section analyses the impact of smart contract design on transaction costs. The analysis focuses on three types of transactions: transfers, approvals and transfers from. The aim of this section is to highlight the impact that smart contract design has on the cost of conducting basic transactions.

2 Taxonomy of Stablecoins

Given the evolving design of cryptocurrencies, classifying specific types of stablecoins can be challenging. Additionally, the introduction of new stablecoins with innovative design mechanisms adds further complexity to this task. Despite this, academics and industry experts predominantly categorise stablecoins based on their collateral types which are used to give them inherent value and help maintain price stability.[1] Collateral types can be broken down into five main groups: stablecoins collateralised by fiat currencies, commodities, RWAs, other cryptocurrencies, or those with no collateral at all. Another popular method is to categorise stablecoins by the peg which they aim to track. According to this classification, appropriate subgroups are fiat-pegged, commodity-pegged, RWA-pegged, index-pegged, and combination-pegged stablecoins. Stablecoins can also be distinguished by the type of stabilising mechanism used to maintain the peg, examples include supply expansion and contraction, collateralised debt positions (CDPs), rebase models and concentrated liquidity models. Lastly, stablecoins can be distinguished based on their governance structure, two subcategories are identified: centralised governance structures and decentralised governance structures.

To create a comprehensive analysis for this report, it is important to establish an inclusive and informative taxonomy of stablecoins. The aim is to identify a diverse sample of stablecoins that capture the various types and characteristics of these digital assets. To achieve this, we categorise and group the 50 largest stablecoins listed on CoinMarketCap based on the categories described in the previous paragraph. Figure 3 below displays the categorisations used to group these stablecoins.

Figure 3. A Taxonomy of stablecoins

It should be noted that a stablecoin can fall into multiple groups - even within the same category. For example, DAI is collateralised by both cryptocurrencies and RWAs, DOLA uses both algorithmic stabilisation mechanisms (AMM pool management) and leveraged loans.

2.1 Collateral

The rationale for collateralising stablecoins is to provide them with underlying value to ensure stability even during times of market volatility. Collateral reassures investors that their stablecoins can be redeemed or exchanged for the underlying asset, establishing a lower bound on the value of the stablecoin. If the price of the stablecoin deviates from its peg, the collateral is used to buy or sell the coin to bring it back in line with its intended value. Without collateral, the value of a stablecoin would largely be determined by market sentiment, making it highly susceptible to volatility and instability. Stablecoins can vary regarding the types and amounts of collateral used to support their token. The following subsections provide an overview of these subgroups.

2.1.1 Fiat Backed

Figure 4. Market Capitalisation of 5 largest fiat-backed stablecoins

Approximately 40% of the stablecoins in the top 50 by market capitalisation are collateralised by fiat reserves. In the context of this report, 'fiat reserves' encompass both cash and cash equivalents. It is observed that the majority, if not all, of fiat-backed stablecoins derive their support from reserves in the same currency to which they are pegged. For instance, stablecoins like USDT and USDC, which maintain a 1:1 peg to the US dollar, are backed by reserves denominated in US dollars.[13] The rationale behind this approach is to minimise any deviations between the intended value of the stablecoin and the underlying collateral.

The extent of collateral backing for fiat-backed stablecoins, particularly in the case of USDT, has been a contentious topic, attracting scrutiny over claims of its backing’s sufficiency.[14] As of September 30th 2023, based on an independent BDO audit report, Tether holds 85.73% of reserves in cash, cash equivalents and short-term deposits, of which 0.4% is held in cash & bank deposits, and the majority (~76%) is held in U.S. Treasury Bills.[15] The decision for stablecoin issuers to only partially collateralise their tokens in cash can be attributed to various factors. Stablecoin providers face scalability challenges as demand increases, making full cash collateralisation costly and impractical. Opting for partial cash backing allows issuers to allocate resources to other income-generating activities, improving liquidity management and profitability.

While fiat-backed stablecoins may operate with partial cash collateralisation, their stability relies on the assumption that not all investors will seek to redeem their holdings simultaneously. Nevertheless, it is imperative to address instability that could ensue during market turmoil when this assumption is tested. Such a scenario was exemplified by USDC during the Silicon Valley Bank (SVB) collapse in March 2023. USDC is backed by cash and cash equivalents held in banks, a portion of which is lent out for loans and investments. The abrupt downfall of SVB, where Circle had a substantial $3.3 billion in reserves, sparked acute concerns over the redemption and liquidity of USDC.[16] The apprehension of investors was reflected in USDC losing its peg and momentarily trading at $0.88.[17] This episode underscores the vulnerabilities that even fiat-backed stablecoins may face, even when fully collateralised, and highlights the interdependencies between traditional financial markets and the cryptocurrency markets.

2.1.2 Commodity Backed

Another category of stablecoins represents those backed by commodities, these stablecoins are collateralised using tangible commodities such as precious metals or other physical assets. In the top 50, two stablecoins fall into this category – Paxo’s Pax Gold (PAXG) and Tether's XAUt – together holding a market capitalisation of nearly $1 billion. Both stablecoins are pegged to the price of gold and are backed by physical gold reserves. The idea of collateralising a stablecoin with gold follows a principle similar to that of fiat-backed stablecoins. It entails securing a reserve of physical gold that corresponds proportionally to the circulating supply of the stablecoin.

In the case of Pax Gold, each PAXG token is backed 1:1 to a fine ounce of gold.[18] The physical gold reserves are securely stored in LBMA (London Bullion Market Association) approved vaults located in London. These vaults undergo regular audits conducted by third-party firms to ensure transparency and validate the existence and quality of the gold holdings. PAXG holders have the option to redeem their tokens for physical gold. The redemption process allows token holders to convert their PAXG tokens back into actual gold, which can be physically delivered or stored securely on their behalf. Similarly, Tether Gold (XAUt) provides token holders with the option to deliver physical gold to any address in Switzerland.[19]

While gold-backed stablecoins stand as the sole commodity-backed stablecoins within the top 50 by market capitalisation, it should be acknowledged that other commodities, such as silver and diamonds, have also been employed as collateral to create stablecoins.[20]

2.1.3. Real-World Assets (RWAs)

Tokenisation of RWAs is gaining traction within the cryptocurrency domain. This process involves the issuance of tokens that represent a tangible asset, thus enabling these assets to be traded on-chain. The primary benefits of this approach include democratising access to investment opportunities by lowering entry barriers, enhancing asset liquidity, and streamlining transactions by reducing the need for traditional financial intermediaries. The scope of RWAs is diverse and can encompass a variety of asset classes including, but not limited to, real estate, fine art, and precious metals.

In the context of stablecoins, the adoption of RWAs has emerged as a strategy to generate yield on-chain. By tokenising “stable assets” such as treasury bills, stablecoins can benefit from high-interest rate environments and compete with traditional low-risk investment instruments. A prime example is DAI, which, following a MakerDAO governance vote in June 2021, incorporated RWAs into its collateral framework.[21] More recently, in June 2023, MakerDAO voted to increase DAI’s RWA backing by $700 million by investing in U.S. Treasury bills. The investment was part of a proposal that was introduced in March 2023 to increase the upper limit of DAI’s RWA vault to $1.2 billion.[22] Another example of a stablecoin incorporating RWAs as collateral is TangibleDAO’s Real USD (USDR). USDR maintains a dual collateral system: 50% backed by tokenised real estate — with rental income disbursed daily to USDR holders — and the remaining 50% backed by DAI. In October 2023, USDR experienced a significant de-pegging incident and it is currently trading at around $0.50 [23] due to a “run on the bank” event, wherein all the liquid DAI reserves from USDR’s treasury were swiftly depleted.[24] This instance underscores the potential vulnerabilities in RWA-backed stablecoin designs. However, more projects are pursuing the idea of using RWAs as a form of collateral. For example, Swiss-issued Edelcoin (EDLC) was recently launched in October 2023 as a USD-pegged over-collateralised (125%) stablecoin backed by a bask of metals such as copper, nickel wire and caesium-133.[25]

2.1.4 Cryptocurrency Backed

The third category encompasses stablecoins that rely on collateral in the form of other cryptocurrencies, which may also include other stablecoins. This category typically employs an over-collateralisation strategy to buffer against the inherent price volatility of the crypto assets used as collateral.[26] Within the top 50 stablecoins by market capitalisation, 25 are collateralised using other cryptocurrencies. The market capitalisation of the three largest cryptocurrency-backed stablecoins is presented in Figure 5 below.

Figure 5. Market Capitalisation of cryptocurrency-backed stablecoins

Among the stablecoins in this category, the largest is DAI, which operates under the governance of MakerDAO. Launched in December 2017, DAI has experienced substantial growth and now has a market capitalisation of over $5 billion. MakerDAO, through its community-driven governance model, empowers token holders to actively participate in shaping the parameters governing DAI's collateral.[27] Participants within MakerDAO have voting rights to decide on matters such as the selection of collateral types and the collateral amount, known as the collateral ratio, used to back DAI. Initially, only ETH was accepted as collateral, but now several different cryptocurrencies are employed, including USDC.[28] In fact, DAI is now partially backed by RWAs including US treasury bills, the decision was made via a governance proposal in June 2021.[29]

At the start of 2023, nearly 50% of DAI's collateral consisted of fiat-backed stablecoin USDC.[30] Recognising the risks inherent in such reliance, including the potential for regulatory impacts on USDC and challenges related to liquidity, DAI has since broadened its collateral base, reducing USDC to under 8% of its total collateral.[31]

USDD, operating on the TRON network and overseen by the TRON DAO Reserve, stands as the second-largest cryptocurrency-backed stablecoin after DAI. Initially, USDD functioned as a partially algorithmically backed stablecoin, relying on an algorithmic mechanism for maintaining stability. However, in response to the collapse of Terra LUNA's algorithmic stablecoin UST, USDD strategically pivoted towards an over-collateralised cryptocurrency-backed model similar to DAI.[32]

Under this new framework, the USDD protocol diversified its collateral portfolio to include a wide range of liquid cryptocurrencies such as BTC, TUSD, and TRX. These assets serve as a robust foundation, ensuring that the total value of collateralised assets consistently exceeds the total value of USDD in circulation. The collateral ratio is set at a minimum of 120%, providing an additional layer of security to stabilise the price of USDD.[33] At present, the collateralisation ratio stands at 192%, with nearly $1.4 billion worth of collateral backing $700 million USDD.[34]

Unlike DAI and USDD, which utilise a diversified basket of multiple cryptocurrencies as collateral, LUSD, another stablecoin in this category, stands out by being solely backed by ETH. LUSD maintains its peg to the US dollar through a collateralisation model known as the Stability Pool.[35] LUSD’s model allows users to deposit ETH as collateral and mint LUSD against their deposit.

2.1.5 No Collateral

The final category represents stablecoins which do not rely on collateral to maintain their value, instead, these stablecoins use economic incentives and algorithms written in smart contracts to achieve price stability. In the top 50 by market capitalisation, currently, only four stablecoins in this category maintain a significant market presence, despite historical challenges. Notably, two such stablecoins, UST and KRT, lost their peg in the wake of the Terra LUNA collapse but retained sufficient market capitalisation to remain among the top 50. Algorithmic stablecoins have previously achieved substantial market positions, with Terra’s UST reaching a market capitalisation close to $19 billion in May 2022, making it the third-largest stablecoin at the time.[36] This dramatic rise and subsequent fall of UST underscores the potential and risks associated with algorithmic stablecoins. Further analysis of the design and market dynamics of algorithmic stablecoins is detailed in Section 2.2.3.

2.2 Stabilising Mechanisms

Maintaining a stable price is a crucial aspect of stablecoins, and any deviation from the peg requires a mechanism to adjust the price. These price-stabilising mechanisms are designed in such a way that rational investors will be incentivised to act in a way to maintain the peg of the stablecoin. The specific mechanics employed vary across different stablecoin models, each tailored to trigger the right investor actions to sustain the peg. We can categorise stablecoins based on the distinct designs of these stabilising systems.

Supply Expansion & Contraction

To maintain price stability, most stablecoins that are fully collateralised by a reserve asset, like fiat currency, manage their price by regulating the token supply through a process involving arbitrage. Arbitrageurs are critical to this mechanism—they are investors who seek to profit from price discrepancies between different markets. When the price of a stablecoin drifts below its peg—for instance, dropping to

$0.90 when it's supposed to be $1—arbitrageurs can profit by purchasing the stablecoin and redeeming it from the issuer at the full $1 value. This redemption reduces the number of stablecoins in circulation, theoretically increasing the price due to reduced supply.

Conversely, if the stablecoin's market price exceeds $1, arbitrageurs have an incentive to "mint" new coins. Minting involves depositing an amount of the pegged asset with the issuer to receive an equivalent amount of stablecoins. This increases the supply, exerting a downward pressure on the price, guiding it back toward the peg.

While these arbitrage actions help align the stablecoin's price with its peg, it is important to note that the process is not immediate and depends on efficient market conditions. If arbitrageurs are not active or market conditions are turbulent, the price adjustment mechanism could be slower, leading to prolonged periods of deviation from the peg. Additionally, significant arbitrage actions can impact the liquidity of the stablecoin and potentially affect the value of the underlying collateral, especially if large amounts of the stablecoin are redeemed in a short period.

In essence, the stabilisation of a stablecoin's price is a dynamic process that relies on continuous and efficient arbitrage activity to counteract supply and demand imbalances, and it operates under the assumption of rational behaviour and liquid markets.

Commodity-backed stablecoins, such as PAXG, use a similar approach to maintain stability. Rather than being collateralised by a fiat currency, PAXG is backed by physical gold. This design introduces a lower bound on the price of PAXG, as users have the option to redeem their stablecoins for gold. If the market price of PAXG falls below the value of the underlying collateral, users can choose to redeem their PAXG tokens, creating a floor for its value. However, unlike fiat-backed stablecoins, there is no upper bound to the price of PAXG. Users cannot mint new PAXG by depositing additional collateral when its price rises. This limitation arises from logistical challenges, as accepting and verifying individual gold deposits from users would be impractical. Despite this, market forces typically keep the price of PAXG aligned with the value of the underlying gold. Arbitrageurs play a crucial role here; when the price of PAXG exceeds the value of the gold it represents, they may sell PAXG and buy physical gold (or gold derivatives) instead, putting downward pressure on the PAXG price. The converse is true when PAXG's price falls below the value of gold; buying PAXG and redeeming it for gold can push the price up.

In this way, while there is no automated mechanism to cap the price of PAXG, the combined actions of market participants striving for profit through arbitrage tend to naturally regulate its value in relation to the underlying asset.

2.2.1. Leveraged Loans (CDPs)

A popular stabilising mechanism for crypto-backed stablecoins is the use of leveraged loans – also known as collateralised debt positions (CDPs). In our sample, 14 stablecoins use leverage loans to maintain price stability. The most prominent of these, DAI, employs CDPs as the backbone of its stability mechanism. In this system, cryptocurrencies such as ETH are locked as collateral in specialised smart contracts. These CDPs serve as a crucial element in maintaining the stability of DAI by providing collateral for generating new DAI tokens. The amount of DAI that can be generated is determined by the collateralisation ratio set by the protocol users, ensuring that the outstanding DAI remains adequately backed by the value of the collateral.

CDPs are implemented as a safeguard to prevent the risk of under-collateralisation. Should the market value of the assets locked in a CDP fall below a predetermined threshold — the 'liquidation ratio' — the protocol flags the CDP for liquidation. This automatic process involves selling off the collateral to repay the equivalent amount of borrowed DAI, thus preserving the overall health and stability of the system by ensuring that all DAI is backed by sufficient value. Any excess collateral obtained during the liquidation process, after deducting a liquidation fee, is returned to the original CDP owner.

Liquidations reduce the supply of DAI, introducing scarcity into the market. Moreover, when DAI's price dips below its pegged value, it becomes more economical for users to buy DAI, as they can use less collateral to recover the same amount of DAI or to pay down their debts in the system. This purchasing activity creates demand for DAI. The interplay of a tightened supply from liquidations and increased demand from users capitalising on favourable rates facilitates the realignment of DAI's market price with its $1 peg.

2.2.2. Algorithmic

The last category comprises stablecoins which do not rely on collateral to maintain their underlying value and instead depend on smart contracts that encode economic incentives and algorithms to achieve price stability. In our sample, four stablecoins solely rely on algorithmic methods to maintain price stability (UST, KRT, BOB and AMPL) and one stablecoins utilises a combination of algorithms and collateral (CUSD). Today the market share of stablecoins utilising algorithmic price stabilising mechanism is less than 0.5% of the top 50 stablecoins. To fully understand the landscape of stablecoins, it is important to examine the various designs of algorithmic stablecoins, despite their reduced market prominence

Dual asset systems

Dual-asset algorithmic stablecoins pair a primary stablecoin with a secondary volatile coin to counterbalance price fluctuations. This innovative method is exemplified by Terra's UST and LUNA, where LUNA absorbs UST's volatility. Should UST's value fall below its peg, LUNA is sold, and the proceeds are used to shrink the UST supply, bringing its price back towards the peg. Conversely, if UST's price surpasses the peg, more LUNA is minted and distributed, thereby expanding UST's supply and reducing its price.[37]

The Celo protocol, which facilitates the issuance and management of multiple stablecoins such as cUSD and cEUR, employs a dual asset system to maintain price stability around their respective pegs. However, unlike UST, Celo is collateralised by a basket of cryptocurrencies like BTC, ETH, and the platform's native governance token, CELO. For price stabilisation, Celo uses a responsive mechanism: users can mint new cUSD by locking up CELO, or they can burn cUSD to withdraw CELO from the reserve. Should the value of 1 cUSD fall below $1 the protocol intervenes by selling CELO from its reserve to purchase cUSD, reducing its supply and nudging its market value back to the peg. Conversely, when the value of cUSD rises above $1, new cUSD are minted and sold for CELO, increasing the supply and pushing the value down to the target peg. This system creates a dynamic equilibrium that aims to robustly maintain the stablecoin's value in line with its fiat reference.[38]

AMM Management and Concentrated Liquidity

Inverse Finance’s stablecoin DOLA utilises Automated Market Maker (AMM) Feds, which are smart contracts controlled by Inverse Finance DAO through a multisig setup, to ensure its price stability on AMMs like Curve and Balancer.[39] These AMM Feds either mint or burn DOLA in response to market demand in the liquidity pools. When the demand for DOLA rises, new tokens are minted and supplied to the pool, creating a protocol-induced "debt." Conversely, when demand falls, DOLA is withdrawn and burned, reducing this "debt." This mechanism ensures a balanced supply-demand scenario for DOLA, stabilising its price during market volatility, and generating arbitrage opportunities and rewards for the DAO treasury.

Another price stabilising mechanism involves the use of AMMs and the recent innovation of ‘Concentrated Liquidity’ on platforms such as Uniswap.[40] This approach allows liquidity providers to strategically allocate their capital within a specific price range, optimising liquidity for a particular asset. The stablecoin BOB embraces concentrated liquidity by pairing its pre-minted token inventory with existing stable tokens like USDC and BUSD on decentralised exchanges that feature concentrated liquidity mechanisms.[41] This enables BOB to maintain its price stability by ensuring deep liquidity around its target price range, minimising slippage and strengthening its $1 peg. The concentration of liquidity attracts arbitrageurs who can swiftly buy or sell BOB, facilitating market-making activities that help realign its price towards the desired peg.

Rebase Tokens/Elastic Supply

Another algorithmic stabilising mechanism employed by some stablecoins is referred to as elastic supply or rebasing. Ampleforth (AMPL) is a notable example which utilises rebasing to maintain purchasing power over time.[42] AMPL operates on an elastic supply model, meaning that the AMPL token supply expands or contracts in response to price fluctuations. This unique mechanism, known as a "rebase," is executed daily. Instead of relying on a fixed peg to a specific asset or currency, AMPL's rebase adjusts the supply held by each wallet proportionally when the price deviates from its target price. If the price exceeds the target, the supply increases, diluting the value of each token. Conversely, if the price falls below the target, the supply decreases, making each token more valuable. This dynamic supply adjustment incentivises market participants to transact based on price signals and aims to maintain price stability. Likewise, if the value of AMPL declines, each AMPL holder's balance will be decreased accordingly. This makes AMPL a stable unit of account, since by design, the ratio of AMPL’s market capitalisation to the number of AMPL tokens is periodically adjusted to be $1.

AMPL’s rebase mechanism is based on the value of the U.S. dollar in 2019, which provides a safeguard against inflationary pressures. However, it is important to recognise that unlike other stablecoins, AMPL may not serve as a good store of value, as holding AMPL is no different than holding a non-pegged coin. If the market cap of AMPL declines, users' balances and outstanding payments will decline proportionally. Nonetheless, the rebase mechanism helps maintain the stability of AMPL’s purchasing power and protects against the erosion of value due to inflation.

2.3. Governance

Stablecoins can be distinguished based on their governance structure, which can fall into two main categories: centralised and decentralised governance structures. Centralised stablecoins are governed by a single central authority or entity that retains control over key decisions such as the issuance and management of the stablecoin. In contrast, decentralised stablecoins are governed by decentralised autonomous organizations (DAOs), community-driven governance models, where token holders have voting rights and actively participate in decision-making regarding key matters affecting the stablecoin, or by smart contracts alone. The choice of governance structure has implications for transparency, control, and the level of decentralisation within the stablecoin ecosystem.

2.3.1. Decentralised Governance

Decentralised governance models for stablecoins have grown in popularity, driven in part by concerns surrounding centralised entities and doubts about the integrity of fiat reserves. This trend is particularly prominent among stablecoins which are collateralised using cryptocurrencies or algorithmic stablecoins. The decision to implement decentralised governance for these stablecoins makes sense as it permits stakeholders to audit and authenticate funds on the blockchain, heightening transparency and instilling trust among investors. These stablecoins can offer a transparent approach to governance, enhancing accountability and ensuring the integrity of the stablecoin ecosystem. Such decentralised governance models emphasise inclusivity and decentralisation by devolving governance authority and decision-making power to token holders. With their vested interest in preserving price stability and safeguarding ecosystem integrity, token holders actively shape governance, making informed decisions aimed at promoting the long-term sustainability of the project.

Roughly half of the stablecoins in the top 50 by market capitalisation rely on a decentralised governance model, with the degree of governance power and decision-making authority varying across projects. Stablecoins differ with respect to the number of participants and the distribution of voting power among them, which in turn affects their level of decentralisation.. Understanding these dynamics is important as they shape the overall governance structure and security of the project, however an in-depth discussion on these metrics is out of scope of this report.

The longest standing and largest stablecoin utilising a decentralised governance model is DAI. DAI operates under the governance structure of MakerDAO, which is the entity responsible for overseeing the Maker Protocol - a decentralised platform for DAI creation and management. Governance is enacted through MKR, the protocol's native token, granting holders the right to propose and vote on key decisions such as collateral types, collateral ratios, and stability fees.[43] MKR holders are integral to DAI's stability, actively participating in auctions to cover potential system deficits and aligning their incentives with the health of the DAI ecosystem.

The governance process within MakerDAO consists of two main stages: proposal polling to gauge community sentiment, followed by executive voting to enact changes.[44] Proposals, ranging from risk parameters for new collaterals to other critical updates, are first vetted by the community through polling. Successful initiatives then proceed to executive voting, where they are enacted via smart contracts. These contracts are designed to carry out approved governance actions and are immediately effective upon execution. Any Ethereum address can deploy these contracts, but it is the MKR token holders who have the authority to vote and activate the proposals. A minimum quorum is required for the legitimacy of any decision, ensuring that governance reflects the collective will of the community. Through this structure, MKR holders not only maintain the stability and integrity of the DAI ecosystem but also ensure its sustainability for the future.

2.3.2. Centralised Governance

While decentralised stablecoins distribute decision-making power among token holders and prioritise transparency and inclusivity, centralised stablecoins rely on a custodial governance model. In this model, a company or a centralised party has control over the stablecoin's operations and policies. Some examples of stablecoins that follow this centralised approach include USDT, USDC and BUSD. Centralised stablecoins are designed to provide stability by pegging their value to a fiat currency, but token holders place trust in a single entity to manage and maintain the stability of the stablecoin. Often stablecoins utilising a centralised model hold fully-collateralised reserves to back the value of their stablecoins. This custodial nature raises concerns about the concentration of power, lack of transparency, and potential conflicts of interest. Additionally, centralised stablecoins may face regulatory scrutiny and operational risks due to their reliance on a centralised governance structure.

However, centralised stablecoins offer some distinct advantages when compared to decentralised stablecoins. Notably, numerous studies have shown that centralised stablecoins demonstrate considerably lower volatility.[45] This reduced volatility, exemplified by stablecoins like USDT, proves advantageous for investors seeking a stable asset. By contrast, decentralised stablecoins such as DAI may be more prone to deviation from their peg, introducing significant risks for investors, particularly those engaged in leveraging and borrowing volatile cryptocurrencies against stablecoins. In addition to lower volatility, centralised governance models offer efficiency and streamlined decision-making processes. Centralised stablecoins can swiftly respond to market dynamics and implement necessary changes without the need for consensus among a wide range of token holders. Furthermore, the increased regulatory scrutiny faced by centralised stablecoins can provide reassurance to investors, as it ensures compliance with regulatory frameworks and enhances the long-term viability and stability of the stablecoin.

3. Contract Analysis

The section presents the comprehensive analysis undertaken on the contractual framework, ownership structure, and operational control mechanisms for a sample of 10 stablecoins. The sample includes the five largest by market capitalisation: Tether (USDT), USD Coin (USDC), DAI, Binance USD (BUSD), and True USD (TUSD). The remaining stablecoins selected — Ampleforth (AMPL), Frax (FRAX), Liquidity USD (LUSD), Paxos Gold (PAXG), and Inverse Finance’s (DOLA) — were chosen due to their unique characteristics as detailed in the previous section. Table 2 below provides an overview of the stablecoins in this sample.

Table 2. Overview of stablecoin sample

The analysis in this section encompasses an examination of the smart contract code for each stablecoin, emphasising several pivotal aspects that dictate their operation. Key elements such as the ownership structure and controls undergo assessment. The contract's upgradability is determined, along with the ability to pause or shut down a contract. Further, safeguards for token transfers, including blacklisting measures are evaluated. Lastly, permissions and checks relating to the minting and burning of stablecoins are analysed. This methodology provides a comprehensive perspective on the control mechanisms and operational dynamics for the analysed stablecoins. Each of these aspects is discussed in the following sections.

3.1. Proxy Contracts, Pausing & Shutdowns

The fundamental nature of smart contracts — their immutability — while ensuring trust and security, poses challenges when updates or fixes to code become necessary. To address this rigidity, some stablecoins use proxy contracts. Proxy contracts essentially serve as an intermediary layer between users and the core contract which contains the operational logic. They preserve the contract's state (data) and delegate function calls to the linked implementation contract, which contains the actual contract logic. The design of proxy contracts facilitates the alteration of this logic contract, thereby enabling the upgradeability of the smart contracts. This mechanism allows for bug fixes, feature additions, or adaptations to evolving needs, circumventing the inherent limitations of smart contract immutability. Furthermore, as regulatory environments for stablecoins evolve, the upgradeability offered by proxy contracts becomes critical, allowing issuers to adapt by adding features such as the blacklisting of certain addresses in response to legal requirements.

However, proxy contracts come with a significant caveat. While they provide a solution to the immutability of smart contracts, they also introduce an additional layer of centralised control over the stablecoin. Additionally, the implementation of proxy contracts adds additional operating code increasing gas costs for the user.

Nearly all centralised stablecoins examined, which are issued by registered companies, make use of proxy contracts for upgradeability (see Table 3 below). Notable examples include BUSD and PAXG, both managed by Paxos Trust Company, and USDC, issued by the Coinbase-Circle consortium. TUSD, managed by Techteryx Limited, also uses proxy contracts. Tether Limited, the issuer of USDT, utilises a different approach. Instead of a proxy contract, it leverages a "logic upgradeability" mechanism. This method uses a deprecated function, which, when invoked by the contract owner, redirects operations from the old contract to a new one. As with a proxy contract, this allows for the implementation of upgrades and bug fixes. AMPL is the only decentralised stablecoin that uses a proxy contract.

The fact that centralised stablecoin issuers often exhibit a greater tendency to use proxy contracts compared to their decentralised counterpart may be due to regulatory reasons. As registered entities, these stablecoin issuers operate within an evolving regulatory environment that may require future updates or amendments to their smart contracts. Additionally, the inherent structure of centralised stablecoins may lend itself to better management of these changes. Equipped with dedicated teams, they can efficiently handle updates and have the necessary legal and regulatory mechanisms to oversee this process. Conversely, decentralised stablecoins may prioritise immutability and censorship resistance, leaving less room for modifications post-deployment.

Another key element in the design of stablecoins is the capability to pause or shut down the smart contract. These features are usually incorporated as permissioned functions that can only be called by the contract owner or certain privileged addresses. Strict access controls to such functionality are necessary to ensure that these functions are only executed under justifiable circumstances and by credible entities.

USDT, BUSD, PAXG, and USDC all have a similar structure when it comes to the pausing and unpausing of contracts (see Table 3 below). For USDT, BUSD, and PAXG, the control over these functions lies exclusively with the contract owner. USDC, however, approaches contract pausing differently. At the contract's initiation, a specific address has exclusive control over the pausing and unpausing functions. However, the contract owner still retains the power to change this address through an update pauser function. In all these cases, if a contract is paused, several key operations, such as transfers are frozen until the contract is un-paused again. TUSD is the only centralised stablecoin with no pausing or shutdown functionality.

Out of the decentralised stablecoins, only DAI has the functionality to completely shut down its contract. The process of initiating shutdown is controlled by MKR voters in response to serious emergencies such as market irrationality, hacks, or security breaches. This is done by depositing MKR into the Emergency Shutdown Module contract. Once a sufficient amount of MKR tokens has been deposited, the Emergency Shutdown is triggered, and the shutdown functionality can be called by anyone. Once triggered, Vault owners can immediately retrieve excess collateral from their Vaults, while DAI holders can redeem their DAI for a relative share of all collateral types in the system after a waiting period determined by MKR voters. None of the other decentralised stablecoins has pause or shutdown functionality, although FRAX has the functionality to pause the minting and burning functions which can be called by certain addresses.

Table 3. Stablecoin upgradeability, pausing and shutdown.

3.2. Transfer Checks

The transaction process for each of the sampled stablecoins is analysed for transfer, transfer from and approval transactions. Each function is assessed for the presence/absence of the following checks.

- Blacklist: Are there explicit checks in place to ensure that the token holder is not a blacklisted address and/or is not sending to a blacklisted address?

- Burn / Zero Address: Are there explicit checks in place to ensure that the token holder is not transferring to the zero address? The Ethereum zero address is a specific address which is often used to burn tokens making them

- Modifiers: Are modifiers being used to restrict access or the executability of a transfer?

- Additional Checks: Are there any additional checks conducted before the token transfer?

Table 4 below presents an overview of the findings.

Table 4. Stablecoin transfer checks

From Table 4, notice that the centralised stablecoins like USDT, BUSD, USDC and PAXG have more stringent checks in place such as checking for blacklisted addresses and sending to a burn address. These stablecoins also include modifiers such as whenNotPaused to check whether or not the contract is paused before initiating a token transfer.

On the other hand, decentralised stablecoins like DOLA, AMPL, LUSD, and DAI have comparatively fewer checks in place. For instance, DAI and DOLA's transfer functions do not incorporate any specific transfer checks. However, LUSD and AMPL do put some safeguards in place, such as checking for transfers to the zero address, and in the case of AMPL, ensuring that transfers are not being made to the contract's own address. None of the decentralised stablecoins in our sample incorporate blacklist checks.

3.3. Destroy Blacklisted Funds

Certain stablecoin contracts go beyond merely restricting blacklisted accounts from holding and transferring their token. They incorporate additional functions to eliminate the funds associated with these addresses.

For instance, the USDT contract contains a ‘destroy blacklist funds’ function that can be called exclusively by the owner's address. If an account is blacklisted, calling this function sets the account's balance to zero. Similarly, the BUSD and PAXG contracts employ a ‘wipe frozen address’ function that can only be invoked by an address referred to as the assetProtector. This function gives the assetProtector the power to reduce the balance of any blacklisted user to zero. These privileged functions highlight the substantial authority that certain stablecoin contracts possess, with the power to ensure compliance and even manipulate token holder balances under certain circumstances.

3.4. Minting and Burning of Tokens

Minting and burning processes are key operations core to all stablecoin contracts. Minting is the act of generating new tokens (increasing token supply) while burning eliminates existing tokens (reducing token supply).

For centralised entities issuing fiat or commodity-backed stablecoins, strict control measures are put in place for these processes. Specific permissions are granted only to certain addresses—often those managed by the issuer or trusted partners—enabling them to carry out mint and burn operations. This level of control ensures the stablecoin supply accurately mirrors the underlying assets in reserve. Without these safeguards, unrestricted minting could lead to the creation of unbacked tokens and threaten the stability of the stablecoin. On the other hand, cryptocurrency-backed and algorithmic stablecoins often have less restrictive controls over these functions as they operate based on pre-determined rules and algorithms.

Regardless of the type of stablecoin, these functions play a crucial role in maintaining the stability of the token value, which is why robust checks and controls are often implemented around them. Table 5 below summarises the checks and access controls pertaining to the minting and burning of tokens in our sample.

Table 5. Stablecoin mint & burn checks

From Table 5, notice that out of the centralised stablecoins, USDC and TUSD have the most checks in place. For USDC, the permissioned addresses which can mint and burn tokens are set by the “Master Minter.” This address has the authority to update both the roster of approved minters and the quantity each minter is permitted to mint. TUSD checks the proof-of-reserves feed to ensure that the total supply of TUSD does not exceed their reported reserves before minting. USDT has relatively few checks in place for minting and burning, although these functions are restricted to the owner of the contract which may explain the absence of these checks. The two centralised stablecoins issued by Paxos Trust Company, BUSD and PAXG both restrict minting and burning functionality to permissioned addresses and have balance checks in place preventing token burns from exceeding token balance limits.

In contrast, decentralised stablecoins, such as DAI, FRAX, AMPL, LUSD, and DOLA, generally have fewer checks in place. Much like their centralised counterparts, they too restrict minting and burning functionality to permissioned addresses. However, unlike centralised stablecoins, for most of the decentralised stablecoins, these permissioned addresses are often smart contracts whose minting and burning actions are directly influenced by user behaviour (e.g., DaiJoin contract for DAI, DOLA Feds for DOLA).

3.5. Ownership Structures

Understanding the ownership structure of a contract is crucial to the evaluation of the operating dynamics and control limitations within the stablecoin contract. The ownership structure of a stablecoin reveals who holds certain powers, how control is distributed, and what the potential implications are for users and stakeholders.

For centralised stablecoins, the ownership structure is often straightforward. It typically involves a single entity or a consortium having the ultimate authority over certain functionalities of the contract. This clear hierarchical structure can make it easier to manage and implement changes, but it can also present central points of failure or control. On the other hand, decentralised stablecoins can exhibit more complex ownership structures as the inclusion of more stakeholders may necessitate restricting access to certain functionality.

Ownership structures are analysed from two perspectives. Firstly, the ease at which ownership can change after the contract initialisation. Secondly, the presence of any functions that can exclusively be called by the contract owner.

Table 6. Stablecoin ownership

USDT provides the contract owner with exclusive privileges to mint and burn tokens, blacklist addresses, and pause the contract. TUSD offers similar ownership privileges, including minting and burning tokens and blacklisting addresses. Additionally, the owner of TUSD has the authority to enable or disable the proof of reserves feed, which affects token minting based on the reserves held by TUSD.

USDC takes a different approach by assigning specific addresses with privileged functions, while the owner retains the exclusive right to set these addresses. BUSD can be considered as a middle ground between USDT and USDC. In BUSD, the contract owner has the power to pause the contract, but the owner also sets the address responsible for minting and blacklisting. Similar to USDC, the owner of BUSD can change these addresses, but the current address assigned with minting and blacklisting responsibilities also has the authority to modify these addresses.

In the case of PAXG, the contract owner has exclusive rights to pause the contract, while the owner sets the address responsible for minting and blacklisting. Similar to BUSD, the owner of PAXG can change these addresses, and the address currently performing the minting and blacklisting functions also has the ability to modify this address.

DOLA's ownership structure closely resembles that of centralised stablecoins, granting the owner extensive administrative privileges such as appointing a new operator, adding or removing minters, minting or burning tokens, and modifying the operator address. On the other hand, AMPL allows for ownership transfer and goes a step further by enabling the owner to renounce ownership, essentially assigning ownership to the zero address, which cannot be reclaimed. Additionally, the owner of AMPL retains the authority to change the address responsible for handling rebases.

The ownership of LUSD is divided among three immutable addresses: troveManagerAddress, stabilityPoolAddress, and borrowerOperationsAddress. These addresses, inherited from the Ownable contract, are responsible for managing collateral positions, the LUSD pool, and borrower-related operations. The contract owner initialises and sets these addresses, after which ownership is automatically renounced. Once set, the addresses remain fixed, resulting in an inflexible ownership structure for LUSD.

FRAX has a rather flexible ownership structure allowing for transferability of rights. The contract also includes a governance timelock address that has similar privileges to the owner, enabling time-delayed changes to the contract. Access to mint and burn FRAX tokens is granted to specific entities, known as FRAX pools, which are added and removed by the owner or governance address. The ownership and governance roles, including the owner address, governance timelock address, and controller contract address, collectively have the ability to modify system parameters, set fees, and manage the stablecoin's operation.

In the case of DAI, privileged rights are given to “ward” addresses. The address that initially deploys the DAI contract is granted default ward privileges. Ward addresses have exclusive control over mining new DAI and adding/removing wards.

4. Transaction Costs

Conducting a transaction with a stablecoin involves calling a specific function on its smart contract. For the transaction to be added to the blockchain, it must be validated by the Ethereum network. Validators within the network ensure the legitimacy of these transactions and, in return for their services, earn a transaction fee known as 'gas'. This fee compensates validators for securing the network, creating blocks of transactions and maintaining the ledger.

Importantly, different transaction types involve calling different functions, whereby each function has a unique gas cost. The gas costs associated with calling a function depends on its complexity and the contract's architectural design. For instance, additional computational steps, such as checking if a contract is paused or ensuring wallets aren't interacting with a blacklisted account, can increase the gas fees.

As discussed in the previous section, the checks integrated by the smart contracts of the sampled stablecoins exhibit differing degrees of complexity. This presents an interesting avenue for conducting an analysis of the gas costs associated with conducting transactions using each stablecoin. Three function calls are assessed: 'transfer', which moves tokens between accounts; 'transferFrom', facilitating token movement on behalf of another wallet; and 'approve', which allocates permission for a specified token amount to be accessed by another wallet.

From this analysis, several research questions emerge to better understand transaction costs within the stablecoin sample.

- How much has been spent on checks for each of the three transaction types since the stablecoin's inception?

- What is the average cost for each transaction type?

- What is the average cost allocated towards transaction checks for each transaction type?

4.1. Methodology

The analysis uses a systematic methodology to evaluate the gas costs associated with transaction checks for various stablecoin transactions. The following bullet points provide an overview of this process:

- Original Contract Transaction Simulation: Tenderly was used to upload the original smart contracts of each stablecoin and conducted simulated transactions for transfers, transfer from, and approvals.[46] The gas costs for each transaction type for each stablecoin were

- Contract Modification: The smart contract for each stablecoin was forked and edited to remove any censorship checks or modifiers related to the transaction types being This included, for example, removing checks for blacklisted accounts, checks for zero addresses and checks on the contracts' pause status.

- Modified Contract Transaction Simulation: The forked contracts were uploaded to Tenderly and the gas costs associated with simulated transfer, transfer from and approval contracts were recorded.

- Gas Cost Comparison: Deduced the gas costs of the modified contract functions from those of the original contract to isolate the gas spent on censorship and transfer

- Transaction Count: Used Dune Analytics to query the Ethereum blockchain and download datapoints on the number of transactions, the corresponding blocktime and ETH price for each transaction type for each [47]

- USD Cost Calculation: To get the USD cost of censorship for each transaction the isolated gas costs are multiplied by the price of ETH for each transaction over the lifetime of the stablecoin.

4.2. Results

The remainder of this section presents the results relating to the transaction cost analysis:

Gas Costs (Gwei)

The bar charts in Figures 6, 7 and 8 below display the gas costs for each transaction type across the sampled stablecoins denominated in Gwei. Gwei is a subunit of Ether, where 1 Ether equals 1,000,000,000 Gwei, and it's commonly used to measure gas prices on the Ethereum network. In the visual representations:

- The purple bar illustrates the Gwei required for a transaction using the original smart contract of the

- The orange bar depicts the Gwei needed for a transaction when using the modified contract, where the transfer checks have been

- The black bar highlights the difference between the two costs, effectively representing the Gwei directly allocated to transfer

Figure 6. Transfer Gas Costs (Gwei)

Figure 6 shows the Gwei spent for transfers of each stablecoin. The highest gas costs associated with transfer checks are observed for BUSD and PAXG, both standing at 6,782. These stablecoins are both issued by Paxos Limited and share similar smart contract codes, contributing to identical gas costs. The other centralised stablecoins such as USDC, TUSD and USDT all display relatively high transfer costs, especially when compared to their decentralised stablecoins. DOLA and DAI have no transfer checks in place explaining the identical gas costs for both the original and modified contracts. LUSD and FRAX have minimal transfer checks in place resulting in 426 and 275 Gwei savings for both smart contracts respectively.

Figure 7. Transfer From Gas Costs (Gwei)

Figure 7 presents the gas units spent for "Transfer From" operations across the sample of stablecoins. A key observation is that "Transfer From" gas costs are generally higher than simple transfer costs, a result of the added checks required to ensure the function caller's approval to expend funds on another wallet's behalf. The two dominant figures in this assessment are, yet again, BUSD and PAXG, both commanding the highest gas costs standing at 9,060 Gwei. When comparing the decentralised versus centralised stablecoins, the decentralised group, encompassing FRAX, AMPL, DOLA, and DAI, averages only about 2% gas costs associated with transfer from checks compared to the centralised stablecoins, namely BUSD, PAXG, USDC, USDT, and TUSD.

Figure 8. Approval Gas Costs (Gwei)

Figure 8 displays the gas units associated with approval transactions for various stablecoins. Across the board, it's evident that approval costs tend to be the most gas-intensive transaction type when compared to both transfer and "Transfer From" costs. Once again BUSD and PAXG consume the most gas with both contracts’ approval checks consuming a notable 6,687 Gwei each. Contrasting this, USDT, stands out as the only centralised stablecoin implementing no approval checks, resulting in no differential between its original and modified contract gas costs. A similar pattern is observed for decentralised stablecoins DOLA, DAI, LUSD and AMPL, all containing no checks pertaining to the approval transaction. LUSD, implements minimal checks, translating to a marginal difference of 70 Gwei between its original and modified contracts.

Transaction Count

To assess the total cost allocated to checks for stablecoin transactions it is necessary to determine the total number of transactions over the lifespan of a stablecoin.

The total and average daily number of transactions for each stablecoin are presented in Table 7 below.

Table 7. Cumulative and average daily number of transactions

Among the stablecoins presented in Table 7, USDT stands by having a substantially higher transaction volume both in terms of its total transaction count and on a daily basis compared to the other stablecoins. Specifically, USDT’s cumulative transaction count is 214 million with a daily average is 102,656 transactions. This volume is remarkably higher than the sum of all other stablecoins transactions combined. Notably, a vast majority of USDT’s transactions are in the form of transfers. USDC has a nearly equivalent number of total “Transfer From” transactions as USDT at 35.83 million. USDC’s daily average “Transfer From” number of transactions is 19,450 which is higher than USDT’s 17,238. USDC also has a higher number of total “Approve” transactions (4,078 compared to USDT's 3,257). Among the decentralised stablecoins, DAI has processed the largest amount of transactions, with a cumulative total of 21.21 million and a daily average of 14,968. Conversely, DOLA ranks as the least transacted stablecoin with a cumulative total of 78,000 and a daily average of only 82.

It should be noted that the figures in Table 7 represent the total and daily average number of transactions since the inception of each stablecoin. Among the stablecoins listed, USDT has been in circulation for the longest duration, which gives it a head start in accumulating a higher volume of transactions. This longevity, coupled with its sustained position as the most traded stablecoin, substantially contributes to its significantly larger number of transactions when compared to the other stablecoins in the sample.

Figure 9 below illustrates the trend of the cumulative transaction count for USDT and USDC in comparison to the other stablecoins featured in the sample.

Figure 9. Cumulative number of transactions

Observing Figure 9, it's evident that USDT has consistently dominated the market in terms of its transaction count since its inception, even with the introduction of various other stablecoins over time. While USDC has managed to capture a notable market share, its growth trajectory, when juxtaposed against USDT's, underscores USDT's prevailing market dominance. The trend clearly indicates that, despite competition, USDT retains its position as the most traded stablecoin.

Total Cost of Transaction Checks

This section presents the total amount spent on transaction checks since the inception of each stablecoin. The method involves multiplying the Gwei used for transfer checks by the price of Ethereum at the respective transaction time. To get a total, these costs are summed over the stablecoins' lifetime. Figure 10 presents the total cost for USDT and USDC, while Figure 11 presents the costs for the other stablecoins in the sample.

Figure 10. Cost of transaction checks – USDT and USDC

Since USDT's inception, the data reveals that nearly $100 million was spent on transfer checks (for 214 million transactions). Of this $100 million, $82 million pertained to checks related to token transfers, while $17 million was spent on checks for transfers from transactions. Notably, USDT does not incorporate approval checks. In comparison, since inception, roughly $87 million was spent on transaction checks relating to USDC. Specifically, $40 million was spent on transfer transactions, $41 million on transfer from transactions, and $6m for approval transactions.

Figure 11. Cost of transaction checks – Alternative stablecoins

Figure 11 shows that BUSD has incurred the third largest expenditure on transaction checks albeit it is significantly smaller than USDT and USDC, with a total of $3.6 million spent. The cost of transfer checks for the remaining stablecoins is less than $1 million. DAI and DOLA are excluded from Figure 11 due to the absence of transfer checks in their smart contracts.

While analysing the total spent on transfer checks is interesting, especially from a societal perspective (for instance, comparing it to the total spent on AML checks in the financial services industry), these figures are heavily influenced by transaction volume. This makes a comparison between the stablecoins in terms of dollars spent on transactions relatively meaningless. Therefore, in the subsequent section, the average cost of transfer checks is analysed instead.

Average Cost of Transactions and Transaction Checks

The average cost of censorship is calculated by dividing the total cost of each transaction type by the respective number of transactions for each stablecoin, the results are presented in Figure 12. However, it's essential to consider that transaction costs are influenced by the price of ETH, which fluctuates over time. Given that transactions for each stablecoin occur at different intervals, this variation in ETH price can impact the average transaction cost calculated.

Figure 12 below shows the average cost for each type of transaction using the original (unmodified) smart contract for each stablecoin.

Figure 12. Average cost of transactions

Figure 12 provides a breakdown of the average transaction costs associated with various stablecoins. The four most expensive stablecoins to transfer, based on the average transaction cost, are PAXG, AMPL, BUSD, and FRAX. Notably, all of these utilise proxy contracts, as outlined in Table 3. In contrast, the four least expensive stablecoins to transact, in terms of average transaction cost, do not employ proxy contracts. This observation underscores the idea that proxy contracts play a significant role in amplifying transaction costs.

PAXG stands out with the highest average transaction cost, just above $4. This elevated average can be attributed to its relatively high transfer from transaction costs, which nears the $5 mark. On the other hand, historically, BUSD has been the most expensive stablecoin to conduct a transfer transaction.

Comparatively, USDT emerges as a relatively economical choice in terms of transaction cost. With both its transfer and approval transactions costing less than $2.5. This further underscores the idea that USDT’s nearly $100 million expenditure on transaction checks arises more from its high transaction volume instead of being inherently costly to transact.

DOLA distinguishes itself by having the lowest cost for initiating a transfer transaction, which falls below $2. When evaluating the three transaction types on average, DAI stands out as the most cost-effective stablecoin to transact.

Figure 13. Average cost of transaction checks

Figure 13 depicts the average cost of transfer checks associated with different transaction types. It's evident that PAXG and BUSD incur the highest expenses on transaction checks. Specifically, PAXG averages just below $1, while BUSD is close behind at nearly $0.90. What's intriguing is that the stablecoins with the costliest check in place, namely PAXG, BUSD, USDC, TUSD, and USDT, are all centralised stablecoins. This higher cost can likely be attributed to more rigorous checks implemented for all three transaction types, as referenced in Table 4.

For all stablecoins, checks associated with "transfer from" transactions are the priciest, trailed by approvals and then basic transfers. Notably, DAI and DOLA don’t incorporate any transfer checks and the cost of any transaction with these stablecoins is therefore zero. LUSD and FRAX, on the other hand, implement minimal checks, resulting in an average dollar cost of $0.04 and $0.038 respectively. This figure sheds light on the cost dynamics of transaction checks across different stablecoins and the potential influence of their centralised or decentralised nature.

5. Conclusion

The intention of this report is to provide the reader with a thorough understanding of the current $126 billion dollar stablecoin market. By analysing various characteristics of the 50 largest stablecoins, a taxonomy is developed to categorise stablecoins according to key metrics such as collateral type, peg, stabilisation mechanism and governance structures. These categories are not mutually exclusive, and examples are presented whereby stablecoins fall into multiple categories. Additionally, the design of stablecoins can evolve, influenced by governance decisions, such as FRAX’s transition from partially utilising an algorithmic stabilisation mechanism to becoming fully collateralised by cryptocurrencies, or DAI’s expansion from cryptocurrency-only collateral to incorporating real-world assets in its backing.

From this classification, a focused analysis on a subset of 10 stablecoins (USDT, USDC, BUSD, TUSD, PAXG, DAI, AMPL, DOLA, LUSD, and FRAX) is conducted, delving into their smart contracts in terms of contractual arrangements, ownership structures, and transaction checks. Findings suggest that centralised stablecoins are more inclined to proxy contracts, imposing more stringent transaction checks compared to decentralised stablecoins. This could be due to centralised entities aiming to mitigate regulatory risks while decentralised ones may emphasise resistance to censorship.

Furthermore, the report evaluates the impact of smart contract design and the presence of transaction checks on transaction costs. The assessment reveals that nearly $100 million has been spent on USDT transaction checks and $87 million for USDC. These figures dwarf the costs for the rest of the sample, with only $2.3 million spent on checks related to BUSD, and DOLA and DAI lacking transaction checks altogether, thus incurring no such costs. The significant expenses for USDT and USDC can largely be attributed to their higher transaction volume over time.

Historical data analysis sheds light on the average cost of executing transfers, 'transfer from' operations, and approvals for each stablecoin. It emerges that centralised stablecoins, which often employ proxy contracts and rigorous checks, face higher transaction fees. PAXG ranks as the most costly, averaging over $4.80 per transaction, while DAI is the most economical at approximately $2.30 per transaction. When examining average costs related to transaction checks, PAXG again stands as the priciest, almost $1.00 per transaction, whereas LUSD and FRAX, with minimal checks, average $0.05 and $0.04 respectively.

Academic References

Fiedler, I., & Ante, L. (2023). Stablecoins. In The Emerald Handbook on Cryptoassets: Investment Opportunities and Challenges (pp. 93-105). Emerald Publishing Limited.

Grobys, K., Junttila, J., Kolari, J. W., & Sapkota, N. (2021). On the stability of stablecoins. Journal of Empirical Finance, 64, 207-223.

Jarno, K., & Kołodziejczyk, H. (2021). Does the design of stablecoins impact their volatility? Journal of Risk and Financial Management, 14(2), 42.

Moin, A., Sirer, E. G., & Sekniqi, K. (2019). A classification framework for stablecoin designs. arXiv preprint arXiv:1910.10098.

van der Merwe, A. (2021). A Taxonomy of Cryptocurrencies and Other Digital Assets. Review of Business, 41(1).

---

[1] Estimated using 50 largest stablecoins by market capitalisation as per CoinMarketCap, “CoinMarketCap” <https://coinmarketcap.com/> accessed November 03, 2023

[2] “CoinMarketCap - Tether USDT” < https://coinmarketcap.com/currencies/tether/> accessed November 03, 2023

[3] “CoinMarketCap – Tether USDT – Markets” <https://coinmarketcap.com/currencies/tether/#Markets> accessed November 03, 2023

[4] A stablecoin peg refers to the specific target value that a stablecoin aims to maintain.

[5] Note that Binance has declared its intention to discontinue its support for the Binance USD (BUSD) stablecoin by 2024

[6] For more details on the issuance process of USDT as a leading example in this category see “Tether Issuance Prime” <https://tether.to/en/tether-issuance-primer/> accessed November 03, 2023

[7] "MakerDao – Governance Polls” <https://blog.makerdao.com/governance-polls-june-7-2021/> accessed November 03, 2023

[8] For an overview of sUSD Debt, Minting and Burning see “Debt, Minting, and Burning Explained– Overview”

<https://docs.synthetix.io/staking/staking-guide/debt-minting-and-burning-explained> accessed November 03, 2023

[9] “CoinMarketCap – TerraClassicUSD” < https://coinmarketcap.com/currencies/terrausd/> accessed November 03, 2023

[10] “FRAX Finance – [FIP – 188] Increase CR to 100%” <https://gov.frax.finance/t/fip-188-increase-cr-to-100/2147> accessed November 03, 2023

[11] However, out of the four algorithmic stablecoins in the top 50 two stablecoins – related to Terra (LUNA), UST and KRT – are trading significantly below peg after the collapse of LUNA in May 2022.