Intro - What is sustainable finance? What are the main laws related to sustainable finance?

“Human activities, principally through emissions of greenhouse gases, have unequivocally caused global warming, with global surface temperature reaching 1.1°C above 1850-1900 in 2011-2020. Global greenhouse gas emissions have continued to increase, with unequal historical and ongoing contributions arising from unsustainable energy use, land use and land-use change, lifestyles and patterns of consumption and production across regions, between and within countries, and among individuals."

- According to the Intergovernmental Panel on Climate Change (IPCC)

After the Fifth Assessment Report by the Intergovernmental Panel on Climate Change (IPCC) was finalised in 2014, the United Nations held a climate change conference called COP21 in Paris. This conference resulted in a groundbreaking international treaty called the Paris Agreement, signed by 190 countries to pledge specific, self-imposed goals known as Nationally Determined Contributions (NDCs) to reduce greenhouse gas emissions. This agreement has a critical mission: to keep the increase in global average temperature well below 2 degrees Celsius above pre-industrial levels while striving to limit the rise to 1.5 degrees. This target is more than a number; it's a line of defence against the most severe consequences of climate change, including drastic weather changes, rising sea levels, and significant ecosystem disruptions, all of which are already being felt in some way or another today.

This Paris Agreement provides a global framework to tackle climate change. Sustainable finance is one vehicle that can be adopted to achieve the targets set by the agreement.

Sustainable finance is being actively pursued at the European Union level to underpin the European Green Deal. This initiative aims to redirect private investment, in conjunction with public funds, towards a carbon-neutral economy. Within this EU policy framework, sustainable finance is recognised as a key driver for economic growth that simultaneously alleviates environmental pressures while considering social and governance factors. This concept involves integrating environmental, social, and governance (ESG) criteria into business and investment decisions and emphasises the importance of transparency about ESG risks that might affect the financial system. Moreover, it focuses on managing these risks through effective governance of financial and corporate entities[1].

A key landmark related to Sustainable Finance in Europe was the introduction of the EU Action Plan on Sustainable Finance in March 2018[2]. A major outcome of this plan was the EU Taxonomy Regulation, enacted in June 2020, which created a framework for identifying environmentally sustainable economic activities. Following this, the Sustainable Finance Disclosure Regulation (SFDR), enacted in March 2021, requires financial market participants to openly disclose their approaches to integrating ESG considerations into their investment and risk management processes.

Introduction of MiCA and “sustainable crypto” in the 2nd package of RTSs

The European Securities and Markets Authority (ESMA), in the second consultation package under the Markets in Crypto-Assets Regulation (MiCA), opened the door to "Sustainable Crypto", possibly being the first piece of legislation that ties sustainability and crypto together.

What is ESMA proposing in relation to crypto and sustainability indicators?

The key points of what ESMA is proposing are explained below:

Disclosure Requirements: Articles 19(1), 51(1), and 6(1) of MiCA introduce obligations for disclosing the principal adverse impacts on the climate and other environmental harms caused by the consensus mechanisms used in issuing crypto-assets. These disclosures are required in the white papers for asset-referenced tokens (ARTs), e-money tokens (EMTs), and other crypto-assets.

Responsibility for White Papers: Entities responsible for drafting crypto-asset white papers (referred to as 'persons drawing up crypto-asset white papers') must comply with these disclosure requirements. This applies particularly to operators of trading platforms, who must ensure that by 31 December 2027, compliant white papers are prepared, notified, and published for crypto-assets, excluding ARTs and EMTs, that were admitted to trading before 30 December 2024.

Website Information: Article 66(5) mandates that Crypto-Asset Service Providers (CASPs) display this environmental impact information prominently on their websites for all crypto-assets they service, regardless of whether this information is available in the white papers.

Detailed Specifications by ESMA: Articles 6(12), 19(11), 51(15), and 66(6) task ESMA with specifying the content, methodologies, and presentation of the information regarding sustainability indicators. These indicators must account for various consensus mechanisms and their unique characteristics, including their incentive structures. The sustainability indicators should comprehensively cover aspects like energy usage, renewable energy, natural resource utilisation, waste production, and greenhouse gas emissions.

Now that we know what ESMA is proposing, what are the data points that need to be collected and presented in Whitepapers on CASP websites?

On page 95 of the consultation paper, a detailed table is presented, which summarises all the mandatory data points highlighted by ESMA. A copy of the table is live here.

The four mandatory sections are Energy, Greenhouse gas (GHG) emissions, Waste production and Natural resource use. In the following sections, we will analyse what ESMA mandates to be collected, and some potential issues associated with each metric. From an energy auditing perspective, crypto's decentralised and permissionless nature implies that gathering accurate and relevant data points on each network would be more complex than a traditional energy audit of a centralised permissioned system.

Energy:

Figure 1: ESMA Mandatory Energy Disclosures

The figure above shows the three adverse sustainability indicators related to energy and energy use for a particular crypto network.

At first glance, it is required to come up with the total energy consumed by a particular network for a calendar year (one value representing all energy used for the production, validation, and maintenance of the integrity of the distributed ledger), the share of energy generated from non-renewable sources and finally, the energy intensity for each transaction in the period.

As mentioned previously, the decentralised and permissionless nature of these crypto networks would make it hard to find the absolute values for each of these required metrics.

Proof of Work (PoW) perspective:

One of the best models available for up-to-date estimates of Bitcoin’s daily power demand and annualised electricity consumption estimate is the Cambridge Bitcoin Electricity Consumption Index(CBECI). The scientific approach uses models and gives an estimated output since the Bitcoin network only publishes the global hash rate as an open-source, verifiable data point. The total energy can be estimated from this main data point.

CBECI uses a methodology that was initially developed by Marc Bevand, which builds a basket of real-world hardware with the underlying assumption that mining nodes are rational economic agents that only use profitable hardware. CBECI uses a ceiling and a floor estimate of consumption, with the latter giving the theoretical minimum total power demand based on the best-case assumption that all miners always use the most energy-efficient equipment and the former being the theoretical maximum total power demand based on the worst-case assumption that all miners always use the least energy-efficient hardware as long as running the equipment remains profitable. CBECI also calculate a best-guess estimate based on several assumptions.

As already pointed out, the network's total power consumption cannot be deduced from its total hash rate without being free of significant assumptions and uncertainty. One main limitation is the lack of the exact composition of mining hardware for all mining participants.

In order to be able to report the share of renewable to non-renewable energy sources when analysing a particular network, there needs to be a form of centralisation which collects data from individual miners and mining companies. The Bitcoin Mining Council (BMC) is an open forum of Bitcoin miners committed to promoting transparency, endorsing good practices, and fostering the adoption of industry best practices. By collecting and publishing data on the energy consumption and energy sources of its members' mining operations, the BMC aims to promote transparency about the environmental impact of cryptocurrency mining. The latest report published in August 2023 shows that the BMC represents 43.4% of the global Bitcoin Mining Network, with members spread across 6 continents. The results of the latest survey show that the members of the BMC and participants in the survey are currently utilising electricity with a 63.1% sustainable power mix[1].

Proof of Stake (PoS) perspective:

In PoS, specifically for Ethereum following the Merge[2], most electricity consumption models use sensitivity analysis, which demonstrates how power demand varies depending on diverse hardware and software combinations. Since the precise power demand cannot be ascertained a hypothetical range comprising three scenarios, of which two establish the upper and lower bounds and enclosed within these limits is the best-guess estimate representing a more pragmatic perspective on Ethereum's actual power demand.

Furthermore, after getting the typical bounds for one specific set of hardware/software at different loads, one needs to count the total nodes in the network in order to calculate the overall consumption of the network. Specifically for Ethereum, the number of validator clients is not equal to the number of 'full network nodes', or as defined in most models as "Beacon Chain Nodes", which consist of an execution client, consensus client and validator client. Node counts are obtained via a Peer-to-peer crawler using node discovery protocol discv5 to identify other nodes. This implies that due to the decentralised nature of the network, the actual node count can be different.

Unlike in PoW consensus, there isn't a council of Ethereum validators that collects and reports energy data.

Common Issues:

In all scenarios of PoW and PoS, using the IP addresses of nodes to infer location data cannot be without significant risks and assumptions. In the crypto space, node operators are typically advanced actors which employ technologies such as VPNs and TOR network to mask their real IP. Case in point, 65% of Bitcoin full nodes are hosted on the TOR network, as reported by bitnodes.io.

Without location data, the energy mix, share of renewable energy consumption and GHG emissions of a particular network cannot be accurately assessed.

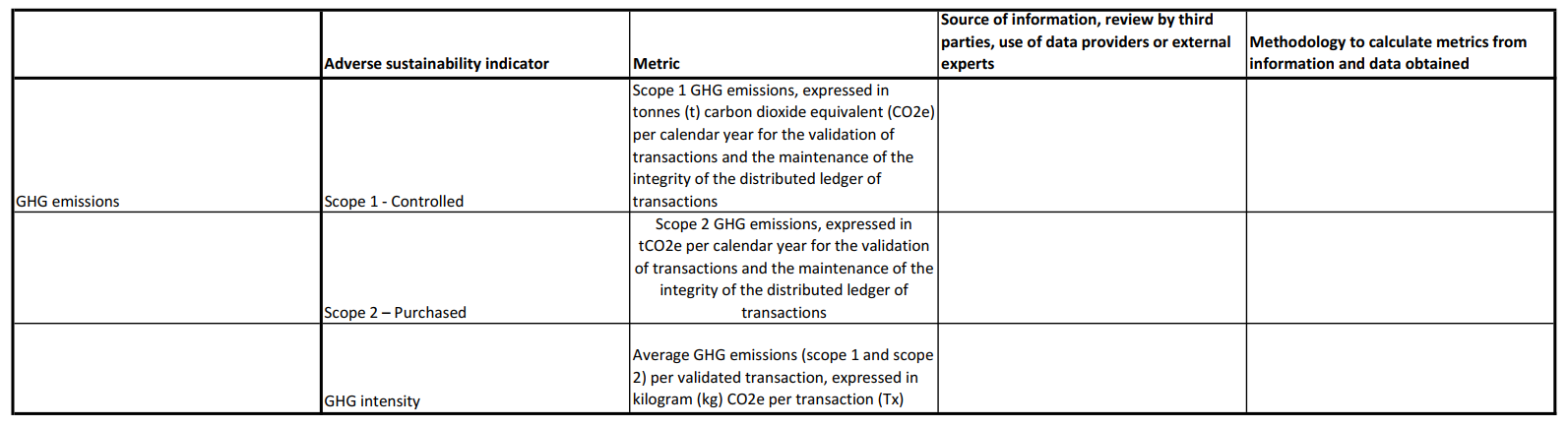

GHG emissions:

Figure 2: ESMA Mandatory GHG Disclosures

Greenhouse gases (GHGs) are defined as the group of gases that contribute to global warming and climate change. The seven Greenhouse Gases (GHG) are carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PCFs), sulphur hexafluoride (SF6) and nitrogen trifluoride (NF3). To make standard reporting easier, all of these gases can be converted to carbon dioxide (or CO2) equivalents in order to make it possible to compare and determine their individual and total contributions to global warming[3]. These disclosures highlighted above are in line with ESRS E1 Climate Change reporting standards.

The concept of "scopes" in GHG emissions was developed to categorise the different sources of emissions, making it easier for organisations to account for and manage their carbon footprint. Scope 1 encompasses all direct emissions from the activities of an organisation or under its control (i.e. sources controlled by the organisation). Scope 2 emissions are indirect GHG emissions from the generation of purchased electricity, steam, heating, and cooling consumed by the reporting company. Note there are two main ways of reporting Scope 2 emissions, either Location-based or Market-based. The location-based method reflects the average emissions intensity of grids on which energy consumption occurs (using regional or national grid averages). The market-based method reflects the GHG emissions from the electricity that the company has purposefully chosen (or contracted) and can include specific renewable energy purchases or certificates.

The use of location data is a vital assumption in the calculation of GHG emissions. Location data is used to calculate the energy mix of a particular location, and thus, reliance on assumptions could lead to inaccuracies in the reported GHG emissions.

Waste Production

Figure 3: ESMA Mandatory Waste Production Disclosures

WEEE refers to waste electrical and electronic equipment. The consensus algorithm of a particular crypto network would have a significant impact on its electronic waste output depending on whether it's Proof of Work or Proof of Stake. ESMA is mandating that for each network, there is a breakdown of the amount of electronic waste generated and the amount of it that can be recycled. Lastly, it also requires disclosures of potential generation of hazardous waste.

In PoW mining, the main driver of electronic waste is hardware ageing and advancement in technology, namely efficiency. ASICs miners are designed for a singular computing purpose: run guesses through the SHA-256 algorithm until the right number is found that creates a hash that starts with the right number of zeroes. Their specialisation is such that they are compatible with only a single mining algorithm, and thus, ASICs tailored for Bitcoin mining are not adaptable for mining other digital currencies. This extreme specialisation means that miners frequently update their equipment to more advanced and efficient versions, making the older miners unprofitable to run, thus becoming electronic waste.

There is minimal research on the actual electronic waste generation of crypto networks. So far, only Alex De Vries has written scientific literature to come up with the electronic waste generated by Bitcoin. Further detailed studies and peer-reviews on this topic are still required. Another observation I noted is that when trying to see the scale of Bitcoin's electronic waste compared to, say, AWS or Google Cloud, I was unable to find these specific metrics in each company's sustainability reporting or corporate communications. On the other hand, energy use and GHG emissions are quite well explained with both AWS and Google having plans in place to be more sustainable.

For PoS networks, there appears to be a gap in the literature discussing electronic waste generation. I would assume that since no specialised hardware is required for consensus, we would get figures resembling the waste generated by, say, a data centre or a cloud data centre since most parts would be general computing components.

Natural resources

Figure 4: ESMA Mandatory Natural Resource Use Disclosures

The last section ESMA highlighted for mandatory disclosures, is the impact of the use of equipment on natural resources, meaning a description of the impact on natural resources of the production, the use and the disposal of the devices of the DLT network nodes.

Alex De Vries, the same author mentioned above in the electronic waste section, tried to quantify Bitcoin's water footprint in his paper on Bitcoin's growing water footprint. He claims that every Bitcoin transaction uses enough water to fill a swimming pool. While I personally disagree with the methodology used and the figures he came up with, I do believe that better research is needed to quantify these values. It is important to note that the Bitcoin Policy Institute has highlighted some selective bias, data misapplication and flawed methodologies in certain papers discussing the sustainability of Bitcoin[1].

De Vries claims that “Bitcoin miners also require water, which is utilised in two main ways. The first involves onsite (direct) water use for cooling systems and air humidification. The second way in which miners use water relates to the (indirect) water consumption associated with generating the electricity necessary to power their devices."

While liquid cooling is being increasingly used in commercial data centres, we cannot assume that all data centres have adopted it. Traditional air-cooling systems in data centres are far more common. But, for the sake of the argument, let's assume that there is liquid cooling for a Bitcoin mining farm:- in this case, there is a closed loop system, meaning no water is lost but gets recirculated to mining rigs after passing through a heat exchanger. As for the second point mentioned, if we are using dams to capture the potential energy of water between an upper lake and a lower lake, does this count as water consumption? In my opinion, both scenarios above refer to the use of water; however, this does not imply water loss or water wastage.

This section could point out other potentially problematic concerns; however, these are not in direct relation to the classification of a PoW or a PoS network but, for example, the resources required to fabricate a microchip. For context, a two-gram microchip requires 32 kilograms of water, 1.6 kilograms of petroleum, and 72 grams of chemicals.

Other general considerations regarding these mandatory disclosures:

In principle, it does not make sense to report a metric (such as energy, GHG emissions or waste production) in relation to the number of validated transactions in a proof of work network. Quoting directly CBECI, “Bitcoin’s energy footprint is linked to block production, not transaction processing. This means that the number of transactions within a block has no impact on its energy expenditure: for a given difficulty level, a full block containing thousands of transactions has the same electricity footprint as an empty block with no transactions.”

While ESMA's approach is thorough in classifying the impact of a particular crypto network, it may not fully highlight the positive environmental aspects of PoW consensus mechanisms. For comprehensive investor awareness, it's very important to consider these positive aspects of certain blockchain-related activities, such as Bitcoin mining. Bitcoin is often termed an "energy buyer of last resort" because it can utilise surplus electricity that might otherwise go to waste, especially in areas where energy cannot be easily stored or transported. This capability allows Bitcoin mining operations to absorb excess energy, contributing to the economic viability of renewable energy sources by providing a flexible, demand-side energy off-take solution, particularly with renewables like wind and solar, which are intermittent and geographically bound. This aspect of BTC mining could aid the global shift towards clean energy and effective grid management, presenting a more balanced view of the sustainability impacts of these technologies. Just because an industry uses 'energy' does not mean it's outright 'bad' from a sustainability perspective.

Furthermore, there is a notable gap in studies and peer reviews of already published material specifically addressing the electronic waste implications for Ethereum or other PoS networks. This overall lack of research and peer reviews on certain topics should be considered in future assessments to ensure a more comprehensive and unified understanding of the sustainability impacts of different consensus mechanisms.

ESMA’s approach to the practicality of using estimates for crypto-asset data in situations of limited availability is commendable. However, it's important that these estimates are transparent and thoroughly explained. Clear detailing of the methodologies, assumptions, and limitations of these estimates is essential for end users assessing tokens. It's recommended that ESMA provides guidance and support, such as standardised data collection methodologies and/or whitelisted data sources, to help entities adapt to these requirements while balancing the need for detailed metrics against the practicalities of data access and costs.

In relation to the above point, a detailed analysis of the output from the tender focused on 'Developing a Methodology and Sustainability Standards for Mitigating the Environmental Impact of Crypto-assets' will be required. The outcome of this tender is supposed to be a feasible and research-based methodology, which will significantly contribute to establishing a comprehensive set of sustainability indicators and reporting standards[2].

Finally, a last point to highlight is that the consultation document expressed a specific stance on Proof of Work (PoW) by emphasising its environmental impact. It stated that transaction validation mechanisms in crypto-assets, like PoW, could significantly affect the climate and environment. Highlighting PoW's reliance on computing power, the document remarked, "Proof of Work consensus mechanisms...can be deemed more impactful from a sustainability point of view." This language reflects an apparent bias towards viewing PoW less favourably due to its sustainability implications.

Conclusion

As we navigate the complexities of integrating sustainability with the rapidly evolving world of cryptocurrencies, ESMA's sustainability disclosure initiatives under the Markets in Crypto-Assets Regulation represents a pioneering step towards acknowledging and addressing the environmental impacts of this digital revolution. While the proposals set forth by ESMA mark an interesting, albeit debatable step forward, they also underscore the nascent stage of our understanding and capability to accurately assess the environmental footprint of crypto-assets. Some gaps and questions are still evident in relation to the mandated disclosures (for example, we haven't looked at how a layer 2 network would need to be analysed, considering its dependence on the layer 1 it's building on) but hopefully, further clarity should be obtained following the outcome of the tender mentioned previously.

ESMA should also give importance to being fair and transparent. If these sustainability disclosers are to bring comprehensive investor awareness then focusing solely on the adverse impacts of the consensus mechanisms, not disclosing model limitations and assumptions and finally classifying PoW consensus as bad since it ‘wastes’ energy does not give a fair or bias-free disclosure. In relation to Bitcoin, the potential of the technology to bring an increase in the adoption of renewable energy is very real and should be a part of the mandated disclosure.

The goal of ESMA should not only be to refine and clarify the existing proposals but also to ensure that the regulations remain adaptive and responsive to both technological advancements and our deepening understanding of environmental sustainability.

-----

About the Author:

Nicholas Abela is a Certified Energy Auditor in accordance with GN 1302 of 2014. This opinion piece follows the submission by BCAS to European Securities and Markets Authority (ESMA) regarding the second consultation on crypto market rules under MiCA. It is important to note that the second consultation package is not equivalent to the final form of the relevant RTS/ITS, and may be subject to change.

[1] https://assets-global.website-files.com/627aa615676bdd1d47ec97d4/65b004ac744cd4c6abb8934e_UN%20Paper%20FINAL%20.pdf

[2] https://etendering.ted.europa.eu/cft/cft-display.html?cftId=15551.

[3] https://bitcoinminingcouncil.com/bitcoin-mining-council-survey-confirms-year-on-year-improvements-in-sustainable-power-and-technological-efficiency-in-h1-2023/

[4] Ethereum migrated from a proof-of-work consensus mechanism to a proof-of-stake consensus mechanism on 15 September 2022. The transition was called The Merge.

[5] https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:Greenhouse_gas_(GHG)

[6] https://finance.ec.europa.eu/sustainable-finance/overview-sustainable-finance_en

[7] https://ec.europa.eu/commission/presscorner/detail/en/IP_18_1404