What is Physical Infrastructure?

Physical infrastructure refers to the basic physical structures required for an economy to function and survive. Examples of such infrastructure include road networks, water, gas and electricity supply, sewers and stormwater drainage, internet, and mobile network connectivity, amongst others. These types of physical infrastructure are usually owned and operated by a country's government or companies and corporations.

What is Decentralised Physical Infrastructure (DePIN)?

Decentralised physical infrastructure (DePIN) refers to these types of physical infrastructure but with a notable difference. DePIN projects use crypto incentives (i.e. tokens) to build out the infrastructure by communities rather than by companies or corporations. These incentives are the impetus for users to deploy infrastructure resources, making the overall network more decentralised, resilient and, at times, even more performant than a centralised counterparty.

How are DePIN Projects Classified?

DePIN terminology is relatively new in crypto, and the term “DePIN” was only coined in November 2022 after Messari conducted a poll on X (formerly Twitter). Before this term, DePIN was referred to using various names such as MachineFi, Proof of Physical Work (PoPW), Token Incentivised Physical Networks (TIPIN) & EdgeFI. Messari has since classified 6 different categories of DePIN in their latest report called "The State of DePIN 2023"[1], being:

- Wireless: Helium & Helium Mobile provide wireless connectivity for the Internet of Things (IoT) devices using LoRaWAN technology and cellular phones using 5G networks respectively.

- Compute: Render & Akash both of which are computing resources marketplaces, one specialized for GPU rendering (Render) while the other is geared toward general-purpose cloud computing (Akash).

- AI: Bittensor which is a specialized protocol for Artificial Intelligence (AI) and Machine Learning (ML) model development.

- Energy: PowerLedger allows the decentralised buying and selling of renewable energy resources.

- Sensors: Hivemapper is a decentralised map-building protocol that uses dashcams as the sensor network to build and aggregate real-world data.

- Services: Nosh and Teleport are bridging the gig economy to crypto via food delivery(Nosh) and ridesharing (Teleport) respectively.

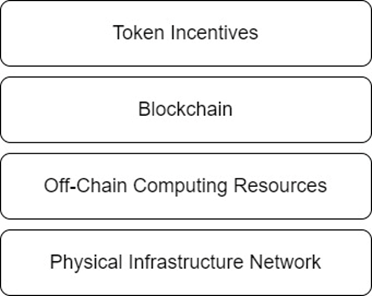

The typical architecture of a DePIN network would be as follows:

Figure 1: DePIN Architecture

- Physical Infrastructure Networks: The real-world components that make up the physical network. This layer can be subdivided into two main resource types – Physical and Digital.

- Off-chain Computing Resources: The middleware or integration layer between real-world devices and blockchain.

- Blockchain Architecture: The distributed permissionless ledger that allows users to transfer value.

- Token Incentives: The economic mechanisms that compel users to carry out the vision of the project (i.e. deploying resources in exchange for tokens). Typically, token incentives are towards the supply side to contribute to network growth.

As already highlighted above, the Physical Layer of a DePIN network can be further classified as either a Physical Resource Network (PRN) or a Digital Resource Network (DRN). PRNs involve the deployment and management of geographically-bound hardware to deliver unique, tangible goods and services to a specific location. This category includes infrastructures like energy and connectivity networks. On the other hand, DRNs are primarily concerned with digital assets and services that can be copied and distributed without regard for physical location. For example, DRNs are networks that offer storage, bandwidth, or computing resources.

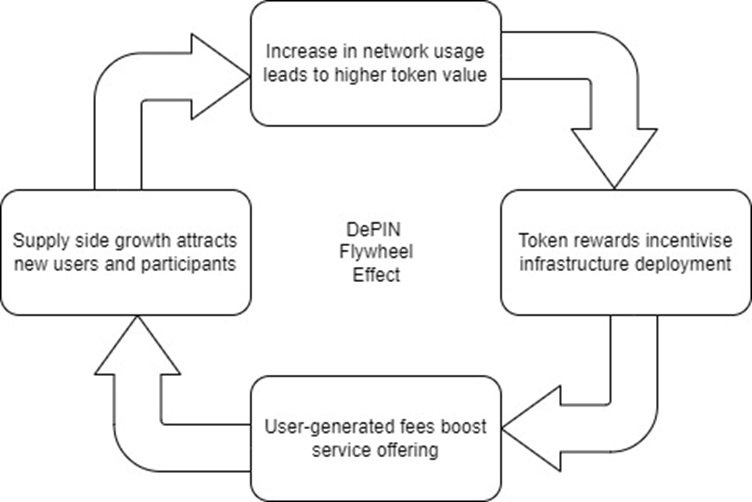

What is the DePIN “Flywheel Effect”?

A pillar which underpins DePIN projects is the so-called "flywheel effect", which contributes to the overall scaling up of the network. This concept is based on the use of tokens within DePIN projects to create a self-reinforcing cycle of positive feedback loops, where increased usage or demand for the network's services leads to an increase in the token's price. This can happen through mechanisms such as token burns or buybacks. As the token price increases, there's an additional incentive for contributors and participants to continue developing and expanding the network.

Figure 2: DePIN Flywheel Effect.

On paper, DePIN is a very attractive model for building out physical infrastructure networks; however, there are several challenges, such as scalability issues and regulatory hurdles, that need to be addressed for these projects to achieve mainstream usage. DePIN can offer several benefits over traditional physical networks, such as decentralisation, censorship resistance, lower infrastructure costs, and more competition and innovation. One can only assess the benefits of DePIN compared to traditional physical infrastructure after fully analysing a project's architecture.

---

[1] https://messari.io/report-pdf/f125632168e9a04e016fe43bc551f412389eda4f.pdf

Topic

Crypto industry